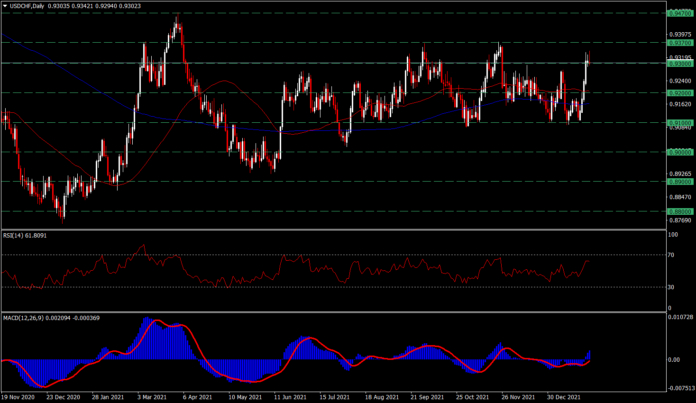

USDCHF consistently showed gains last week and now the bulls are trying to keep it above the 0.9300 level. The results of last week’s hawkish FOMC meeting clearly helped strengthen the USD on the whole and helped the USDCHF out of the 0.9100–0.9200 trading range it has been in since early January.

However, the bears are still trying to keep the USDCHF from rising higher than the November 2021 high of 0.9370, with the 2021 high of 0.9458 being the last resistance level the bears need to defend. The movement of 20- and 50-period SMA in the H4 time interval indicates a Golden Cross, but the RSI-14 and MACD indicators indicate that the USDCHF pair has passed the overbought zone, and a short-term retracement is possible. The 0.9200 level is the closest support to the 0.9100 level and would be activated as support if USDCHF records a sharp fall.

Current sentiment now clearly supports the strengthening of the USD with the market now focusing on speculation of a 50-point rate hike at the March 2022 FOMC meeting against the safe haven currency CHF. The release of NFP data this Friday is expected to give an indication of the movement of the USDCHF in the short term.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.