The markets continue to gyrate wildly amid numerous crosscurrents. Inflation jitters, central bank tightening worries, supply, weakness in EGBs, and strength in risk appetite all weighed heavily on Treasuries. On other occasions, dip buying and geopolitical risks have supported bonds. Meanwhile, Wall Street rallied Tuesday on improving expectations on growth as covid restrictions are eased. Data included marginal widening in the December trade deficit, and declines in both the NFIB small business optimism and the IBD/TIPP economic optimism indexes.

- USD (USDIndex 95.60) steady in a 3-day pattern.

- US Yields 10-year Treasury yield is down -2.2 bp, JGB rates have dropped back -0.4 bp. – Despite that, the Treasury’s $50 bln 3-year auction was surprisingly well received and stronger than expected, garnering record indirect demand.

- Equities – staged a broad rally with tech stocks in Hong Kong rebounding after yesterday’s sell off. Reports of a wave of interventions by state backed funds helped Chinese markets. Hang Seng and CSI 300 rallied 1.97% and 1.07%. The JPN lifted 1.08% and the ASX 1.14%. USA30 & USA100 (+1%) recovered to 35700 and 14828 and USA500 was 0.84% in the green. GER40 and UK100 futures are posting gains of 0.8%. Apple & Microsoft closed higher.

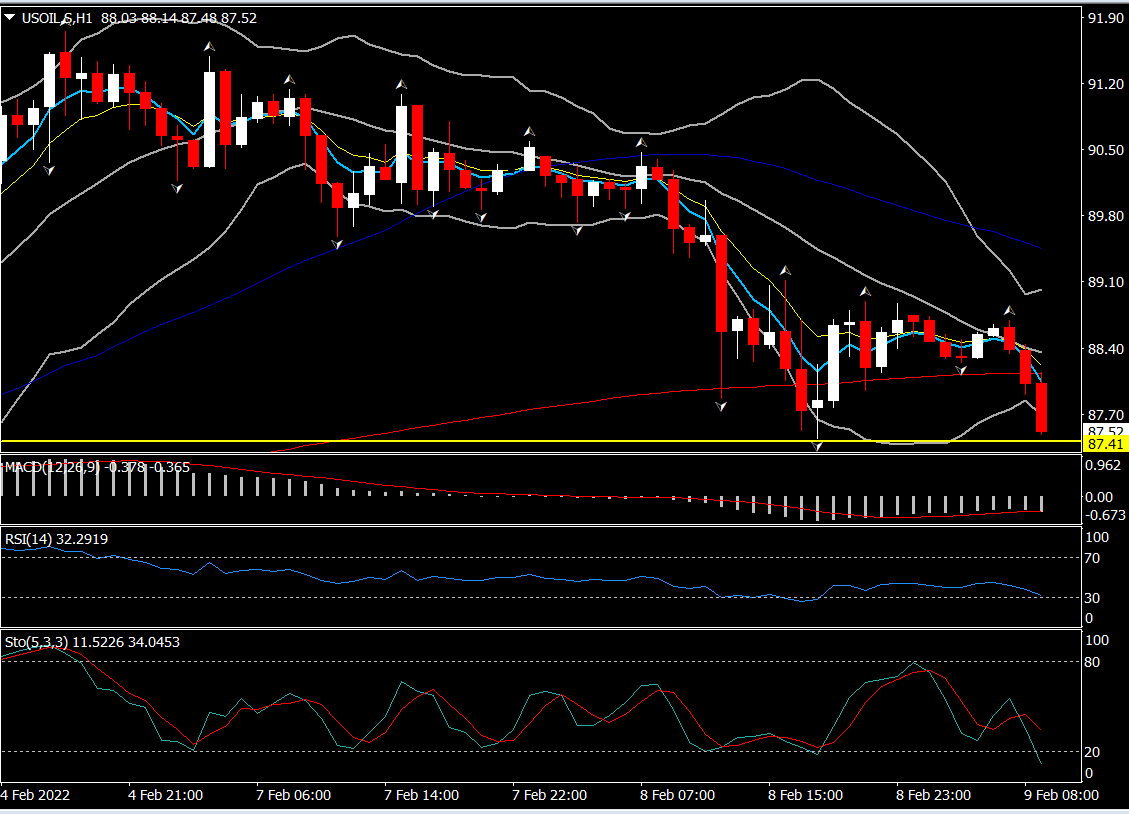

- USOil – extends declines to $87.40.

- Gold – at 1825 after reaching $1829 – Haven buying on geopolitical risks, which has supported on and off, provided little offset.

- Bitcoin settled to mid $43,000.

- FX markets – EURUSD narrowing to 1.1400, USDJPY up to 115.45 & Cable to 1.3537.

European Open – The March 10-year Bund future is up 32 ticks, outperforming versus US futures, while in cash markets the 10-year Treasury yield has dropped back -2.2 bp. Bonds have found a footing for now and EGB yields are set to come off yesterday’s highs, but sentiment is likely to remain fickle ahead of US inflation data. In the Eurozone, markets will likely continue to test the ECB’s resolve, with the recent widening of spreads also reflecting speculation that the APP program could end early to pave the way for a rate hike in the third rather than the fourth quarter.

Germany’s trade surplus narrowed to just EUR 6.8 bln in December in seasonally adjusted terms, as a 4.7% m/m jump in nominal imports far outweighed the 0.9% m/m rise in exports. Virus developments will have weighed on production and exports at the end of the year, while the spike in energy and other commodity prices pushed up the nominal import bill. So not a total surprise with the underlying export trend still robust, despite the drop in exports to the UK last year – thanks to Brexit.

Today – Data is thin with just December wholesale data, but there is a heavy earnings slate today to provide a distraction. The slate includes Toyota, Walt Disney, CVS Health, GlaxoSmithKline, Equinor, CME Group, Uber, Honda, Manulife, Motorola, Twilio, IFF, Sun Life, Equifax, CDW, Seagen, Fox, Grab, MGM Resorts, and Arch Capital.

Biggest FX Mover @ (07:30 GMT) USOIL (-0.56%) Retests 87.40 extending the decline from 91.70. Fast MAs aligned lower, MACD signal line & histogram extend southwards below 0 and RSI and Stochastic are at OS barrier.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.