The markets remain extremely volatile with too many uncertainties to adequately price. However, one near sure bet is for the FOMC to hike rates 25 bps tomorrow. The BoE is also expected to bring a quarter point increase on Thursday.

Bonds are marginally firmer, recovering from recent losses, though yields have pared their overnight rally. Worries over a growth slowdown, especially with China’s lockdowns, brought in some dip buyers. The 2-year Treasury is 2.7 bps lower at 1.835%, while the 10-year is flat at 2.133%. European bond yields are also fractionally lower. The Gilt is unchanged at 1.593%, with the Bund down 1.5 bps to 0.348%. Asian bonds closed in the red with Antipodean markets underperforming with rates up about 6 to 9 bps.

Oil prices have tumbled too. Equities were sharply lower overnight but US equity futures have rebounded into the green with the USA100 0.4% higher, the USA500 up 0.2%, and the Dow marginally firmer. European bourses are holding deeper losses but have come off of their lows. European data added to investor gloom with the plunge in the German ZEW investor confidence index highlighting downside risks. On the other hand, UK labor data was stronger than expected and will keep the BoE on course to hike on Thursday.

The FOMC meets today and Wednesday, and will issue its post-meeting statement at 18:00 GMT on Wednesday. As stated, the markets expect a 25 bp rate hike alongside the completion of the QE tapering process, with verbiage that signals likely rate hikes at upcoming meetings. The SEP will be updated, replacing the forecasts from December. In the Q&A, the markets will seek to gauge the pace of tightening to be expected through the remainder of 2022 and into 2023, as well as the Fed’s sensitivity to growth concerns as the war in Ukraine continues.

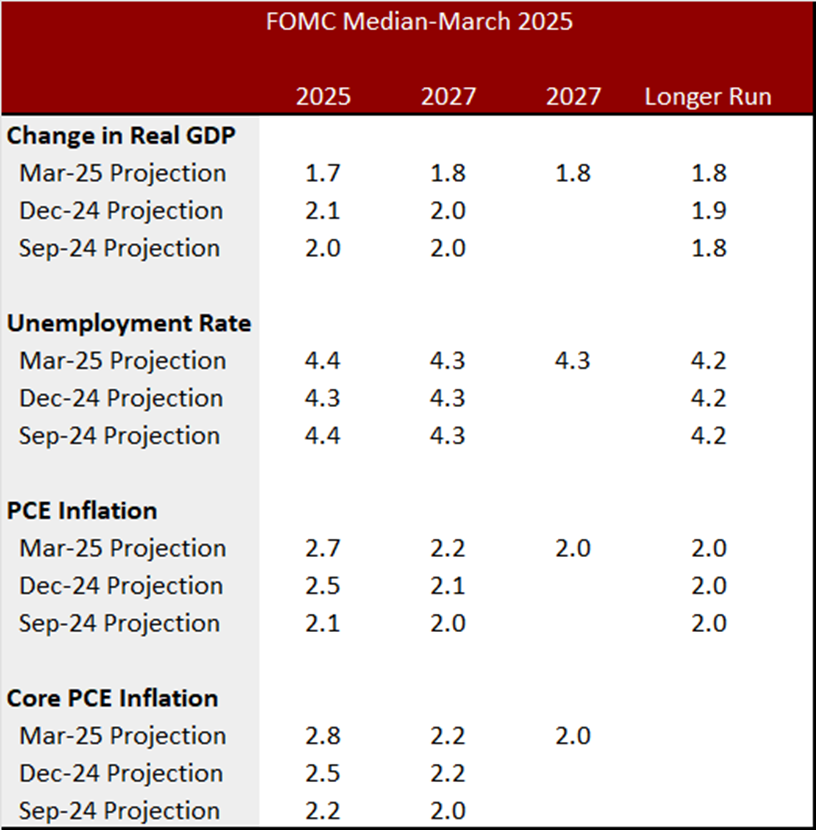

The December SEP revealed big downward revisions in the FOMC forecasts for 2021 GDP and joblessness, and big upward revisions for the 2021 inflation estimates. We expect the same pattern at the March meeting for the 2022 forecasts, though with much bigger upward inflation adjustments.

The median 2022 GDP estimate at this week’s meeting is expected to be lowered to 3.5% from December’s 4.0%. The median jobless rate estimate for 2022 should be trimmed to 3.3% from 3.5%, due to big declines in the prevailing rate since the December meeting.

We’ve seen a powerful updraft in commodity and construction material prices since early 2021 that has gained steam now with disruptions from the war in Ukraine. We saw a February y/y CPI gain of 7.9%, up from 7.5% in January, creating consecutive 40-year highs. We saw a 6.2% y/y gain in October that marked a 31-year high, and gains of 5.4% in September, 5.3% in August, and 5.4% in both July and June that all marked 13-year highs.

The Fed’s favored inflation gauge, the PCE chain price measure, posted January y/y gains of 6.1% for the headline and 5.2% for the core, after respective December y/y gains of 5.8% for the headline and 4.9% for the core, leaving 31-year highs for the headline and core in both months. April of 2020 marked a trough for the inflation measures. The PCE chain price medians for 2022 should be hiked sharply to 4.1% for the headline and 3.7% for the core, following respective medians in December of 2.6% and 2.7%.

Markets will be focused on the Fed’s verbiage in the press conference regarding the expected path for rates through 2022, alongside the Fed’s sensitivity to downside growth risks given disruptions from the war in Ukraine. The markets will also be interested in any references to quantitative tightening, i.e. QT, that many expect later in 2022. The markets will continue to monitor the degree to which the Fed will tolerate the current inflation overshoot, given the Fed’s shift to an average inflation targeting regime in 2020 that will be tested in 2022.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.