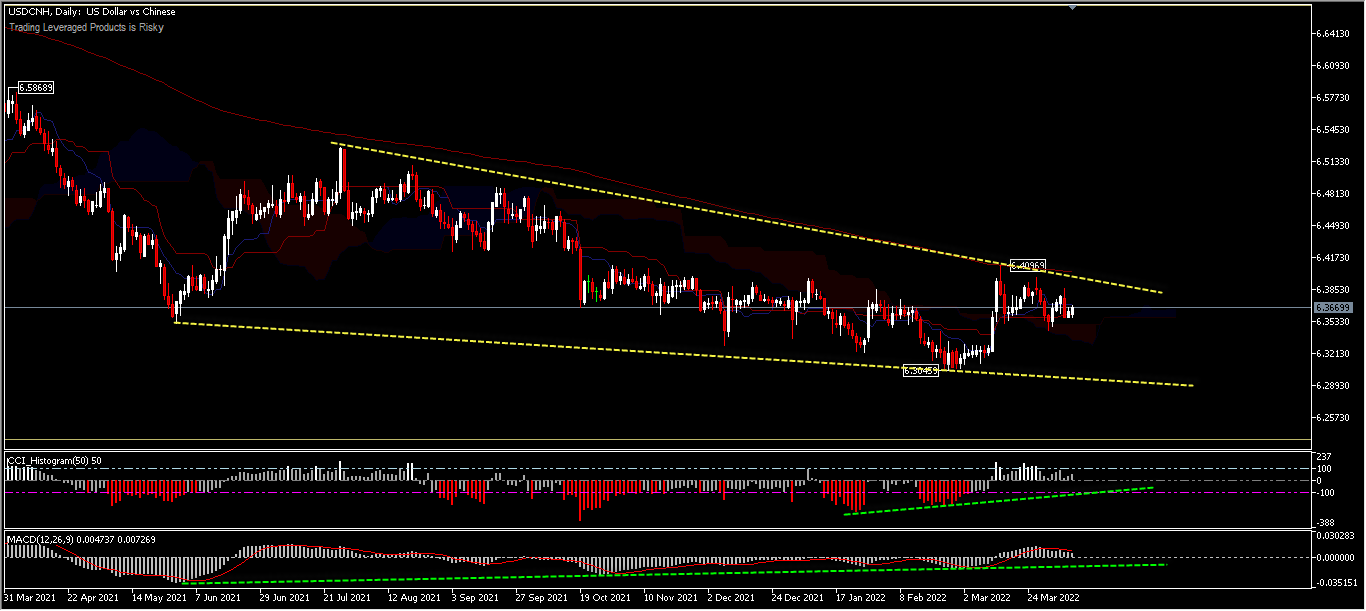

The USDCNH has been trading in a restricted price range throughout 2022 between 6.3045 – 6.4096. Like other currency pairs, investors’ interest in these intersections is determined by trend conditions, the rate of change and general volatility. Payments for coal and oil and other commodities from Russia, India could reduce the dominance of trade in US Dollars. This will bring about changes in the foreign exchange market, although not yet significant ones.

A trend would have a significant impact on the broader foreign exchange market. The USDCNH is currently moving above the key support at 6.2353 in a wedge drop pattern which indicates that the pair is still under pressure but is moving higher, especially if we see a break at 6.4096, that would lead to further strength of USD. A weaker current surplus, low inflation to 0.9%, and declining Chinese bond yields against the US pose an increased downside risk to the Yuan. China’s 10-year government bond yields fell below 2.8%, the lowest level in three weeks and close to the 20-month low of 2.67% on January 25, as sad economic data boosts the PBOC’s chances of further easing of monetary policy.

In the daily time frame, the deviation bias is visible, but requires confirmation of a break of the immediate resistance at 6.4096 (EMA200). In the event of a break and the price moves above it, the pair will target further price levels to start a wave of correction upwards to 6.5275 and 6.5868. If the price continues to move below the resistance level, the downtrend of the wedge pattern could continue to fall in support at 6.3045. Technically, the 2 oscillations support the upward movement, combined with the price movement above the Kumo. While the bias remains neutral, an upward break is needed to confirm the trend change, otherwise the movement will return to the continuing trend.

In the daily time frame, the deviation bias is visible, but requires confirmation of a break of the immediate resistance at 6.4096 (EMA200). In the event of a break and the price moves above it, the pair will target further price levels to start a wave of correction upwards to 6.5275 and 6.5868. If the price continues to move below the resistance level, the downtrend of the wedge pattern could continue to fall in support at 6.3045. Technically, the 2 oscillations support the upward movement, combined with the price movement above the Kumo. While the bias remains neutral, an upward break is needed to confirm the trend change, otherwise the movement will return to the continuing trend.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.