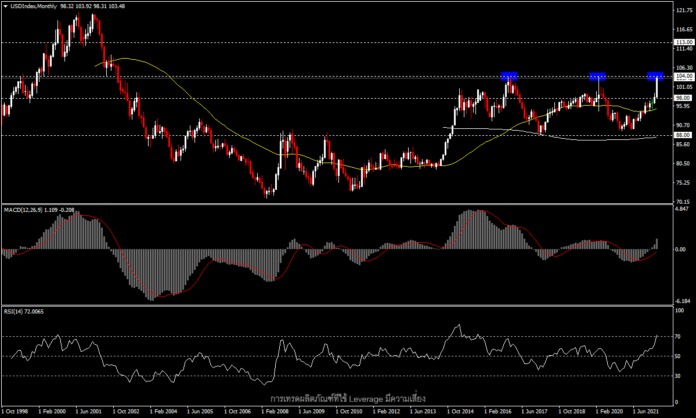

USDIndex, Monthly

The US Dollar continued to gain during April, with the USDIndex rising more than 6%, hitting a new high just shy of 104.00 , the highest point in nearly 20 years, as investors expect the Fed to raise interest rates by 0.5% at their meeting next Wednesday (and possibly many more this year) to curb inflation, driven by a tight labour market. Currently, weekly unemployment claims data are at a record low. The four-week moving average is now at 179k, as is the March non-farm payrolls figure that is expected to continue to point in the same direction at 431k.

However, the preliminary reading for US Q1 GDP growth yesterday contracted for the first time since Q3 2020 at -1.4%, a steep decline from 6.9% in Q4 2021, mainly due to the surge in inflation, trade deficits and lower inventory investments. The same could be true for the March Core PCE inflation figures scheduled to be reported today. This is expected to fall slightly to 0.3% monthly from 0.4% last month, and the annual rate is expected to decline 5.3% year-on-year from 5.4% last month.

The USD strengthening pushed EURUSD to five-year lows in the 1.0500 zone, the GBPUSD pair hit nearly two-year lows below 1.2500, the AUDUSD pair fell to multi-month lows at 0.7050 and lifted USDJPY to a new high in 20 years above 131.00.

The USDIndex technical view in monthly timeframes displays strong momentum in April. This, combined with the Fed’s prospects for several more interest rate hikes during the rest of the year, is expected to be a key factor supporting USDIndex above 104.00, with the next key resistance level at Fibo 161.8 at 113.00. There may be a major correction at the 104.00 resistance area, in line with the movement of RSI entering the overbought zone, with first support at Fibo 61.8 at 98.00, while intraday support and resistance are at the round numbers 103.00 and 104.00 respectively.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.