The escalation of the war in Ukraine and, the prospect of a slowdown in China’s growth following the renewed COVID-19 lockdowns have created a significant disadvantage in risk appetite. Future global growth indicators indicate further decline and geopolitical challenges show no signs of decline. GBPUSD managed to limit last week’s losses, having closed the market with an increase of +0.98% on Friday. However, throughout April, the Pound struggled to move higher, with its largest weekly and monthly declines since June 2021. The strengthening US dollar and international factors are the main drivers of the recent fall in the GBPUSD exchange rate, with the pair testing a new 21-month low at 1.2410 last week, below the key psychological 125.00 level.

Retail sales fell -1.4% last month, while the February drop was revised to -0.4% at the first official indication that rising energy and food costs are offsetting costs that should flow to other parts of the economy. In addition, an IHS Markit Flash PMI survey in April showed that activity in the UK boarding service sector declined sharply.

The BOE is expected to continue its trend of interest rate hikes in each session with another 25 basis points increase later this week. At the last meeting, the hawkish rhetoric seemed to be cooling off, but as inflation continues to warm, the market expects six interest rate hikes this year, with two already applied. The monetary policy report will accompany the decision with new forecasts and a press conference, lead by Governor Bailey.

Technical Overview

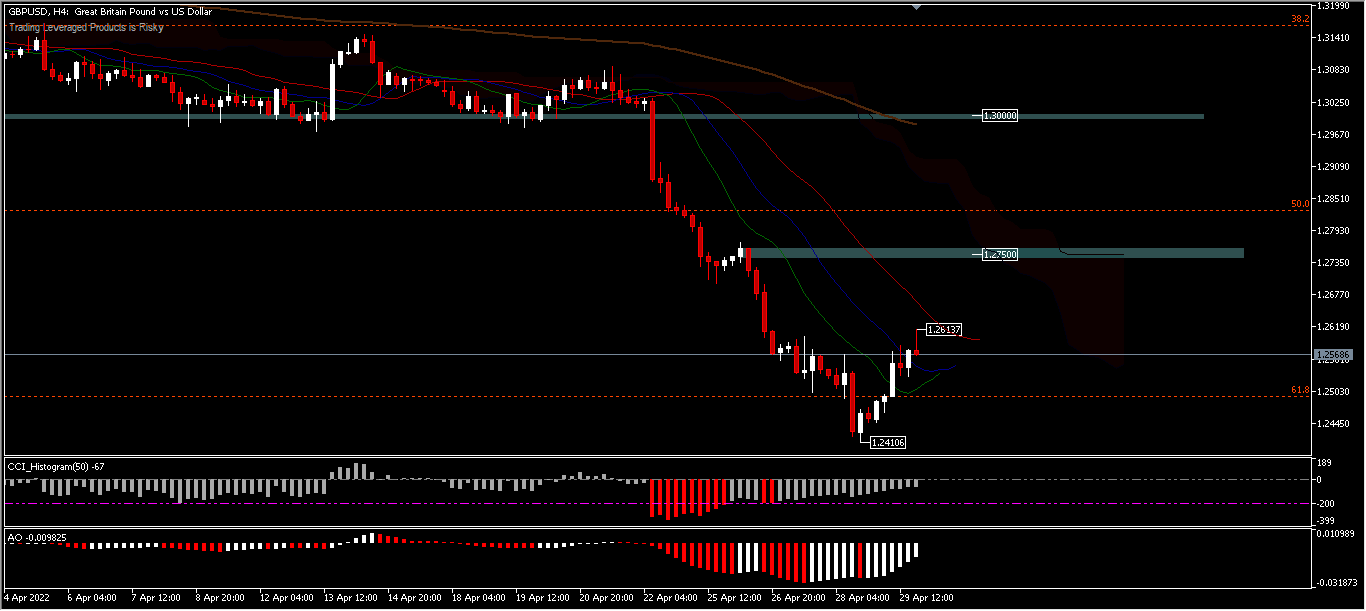

The rise from 1.1408 was completed at 1.4247 and the current dynamic, may be the beginning of a longer-term downtrend. The price of the asset is now stuck at the revaluation level of 61.8% around 1.2500. As long as the resistance 1.3160 is maintained, deeper falls will test 1.2250 and 1.2072.

The overnight bias earlier this week was neutral and likely to consolidate. The uptrend will test 1.2750 and will remain limited below the round number of 1.3000. On the downside, a break of 1.2410 will first target support at 1.2250. In general, the medium-term downtrend is not over yet, although the downtrend has stopped after some gains over the weekend; as shown by the oscillation histogram which is lower in the middle line, the asset price remains below Kumo and EMA200.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.