Can we call the Fed’s most aggressive rate increase since 2000 a dovish hike? The FOMC did the expected and boosted the funds rate by 50 bps, the biggest increase since 2000. It also announced the start of the balance sheet unwind for June 1. Unexpectedly, at least to bond and stock bears, it pushed back against a 75 bp hike and suggested only 50 bp moves were on the table for the next couple of meetings, with follow-up 25 bp tightenings over the remainder of the year. That would put the funds rate in the 2.625% area at year end. The markets had priced in the potential for 75 bp increases and a December rate closer to 2.80%. Ferocious dip buying/short covering rallies ensued in Treasuries and stocks, while the USD lost ground.

- USDIndex drifted to 102.35. Currently trying to recover.

- Equities – Stocks as well as bond markets picked up overnight. GER40 and UK100 futures are still up 2.1% and 1.2% respectively, US futures slightly mixed (USA500 at 4,305, USA30 at 34,034) and across Asia stock markets also moved unevenly. Japan was on holiday, mainland China bourses are finally open again and the CSI 300 is little changed after paring earlier gains.

- Yields plunged alongside a ferocious rally on Wall Street. – Given the Fed’s assumed rate path ending the year at 2.625%, bond yields corrected sharply lower. At the end of the session the December futures contract had dropped to a 2.65% rate. The 2-year yield richened over 15 bp to 2.63%, and the 10-year dropped over 5 bp to 2.92%.

- Oil flirting with 109 high, on EU’s proposed Russian oil ban, but weak China data weighs.

- Gold breached 1900 again.

- Bitcoin rallied at 40,030.

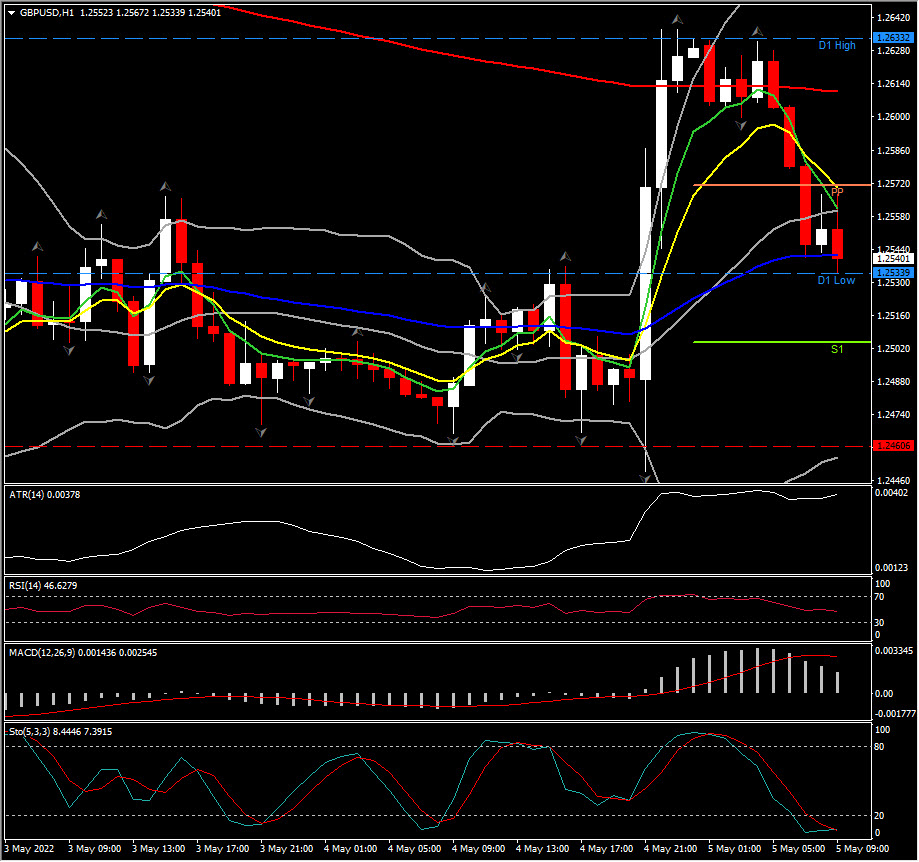

- FX markets – EURUSD retests 1.0500 again, USDJPY sideways at 130.00, Cable drifted below 1.2500 at 1.2460. AUD holds at 0.7120.

European Open: Australia’s 10-year rate dropped back -15.3 bp overnight to 2.38%, and the German 10-year is down -0.1 bp at 0.966% in opening trade, with peripherals rallying and Eurozone spreads narrowing markedly. The latter may have also been impacted by the much weaker than anticipated German orders number at the start of the session, which highlighted the headwinds to the recovery from the Ukraine war, but at the same time added to the arguments against early and aggressive tightening from the ECB. German manufacturing orders plunged -4.7% m/m in March. A much sharper than anticipated contraction and while February numbers were revised up to -0.8% m/m from -2.2% m/m that still highlights the marked impact the war in Ukraine and sanctions against Russia are having on the manufacturing sector.

Biggest FX Mover @ (06:30 GMT) GBPUSD (-0.73%) spiked to 1.2633 overnight before drifting below PP at 1.2533. MAs bearishly crossed and RSI is at 46, MACD lines declining but hold above 0. H1 ATR 0.0038, Daily ATR 0.0125.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.