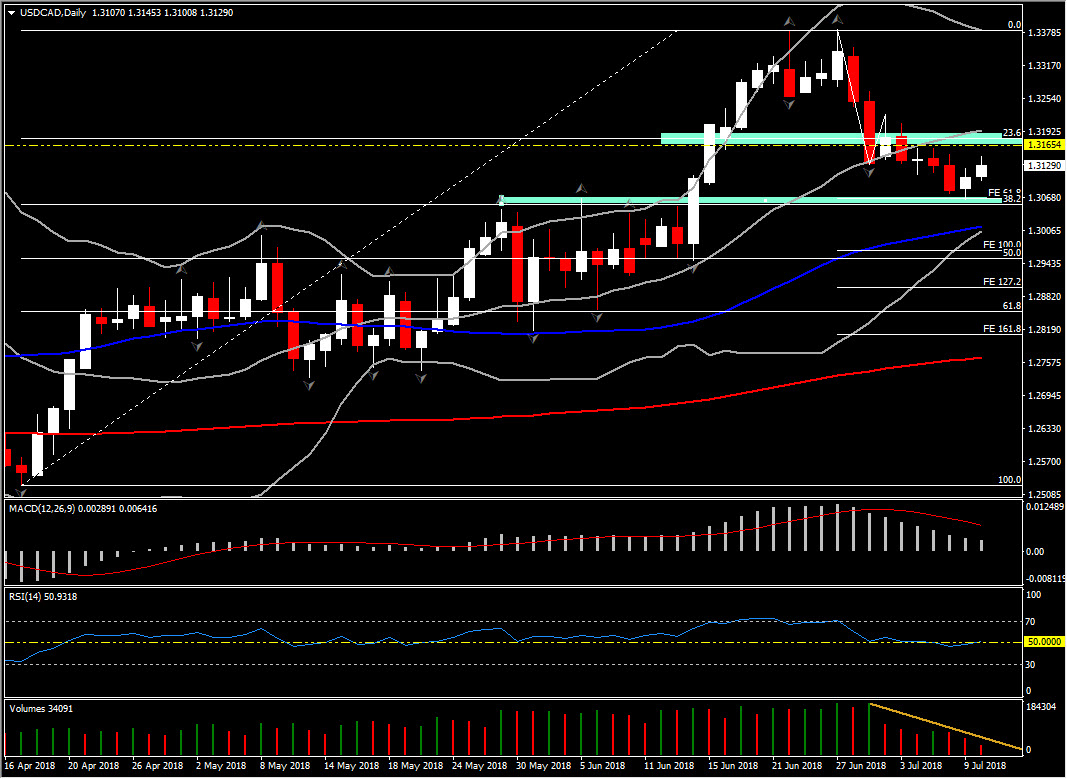

USDCAD, Daily

Canada housing starts surged to a 248.1k growth rate in June from a revised 193.9k pace in May, while Canada building permit values rebounded 4.7% in May (m/m, sa) after the revised 4.7% drop in April (was -4.6%). USDCAD sloped lower to 1.3120 area but immediately rebounded as the housing data seems to be being ignored in the anticipation of BoC Monetary Policy announcement tomorrow.

Today’s upbeat housing figures underpin the already well-supported projection for a 25 bps rate hike from the BoC tomorrow. A rate hike was already widely expected ahead of today’s reports, and the firm data merely confirms that outlook. The accompanying Monetary Policy report should be consistent with additional rate increases, but at a gradual pace. Close attention will be paid to the Bank’s view on the ongoing trade/tariff issues, labor market slack and inflation outlook.

USDCAD printed near 3-week lows of 1.3066, with the pairing adding to last week’ post Canada jobs report losses. Given the widely expected BoC rate hike, USDCAD is likely to remain soft, especially if Oil prices hold recent gains. Support comes in at 1.3045-1.3050, which is the confluence of 38.2% Fibonacci level, the 61.8 Fibonacci expansion level and May’s Resistance level with 3 consecutive daily up fractals. Resistance level stands at 1.3165- 1.3195 area, with the later at the 20-Day MA. A breakout above Resistance area would suggests the bounce up to a 1.3375 peak, while a move below Support could imply a retest of 1.2900-1.2950 area (50% Fib. level and FE 127.2).

Meanwhile, the technical indicators present a neutral to positive bias for the USDCAD. MACD lines drifting lower below signal line but remain within the positive territory, while RSI is fluctuating around neutral zone, both suggesting consolidation in the near future. Oppositely, Volume indicator decreasing, suggest that downside movement is running out of steam and it is likely to retrace to the upside.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/11 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.