Fed Chairman Powell’s Monetary Policy testimony today won’t break new ground, going by the already released report from Friday. The Fed’s assessment was an echo of recent FOMC statements and minutes that have shown the FOMC remains on a gradual normalization course for now, and which will be dependent on economic data in the future. The strength in the economy and the rise in inflation, albeit modest, won’t pull the Committee out of its comfort zone, especially as wages remain tame, and with signs that slack remains in the labor force. The Fed chief will likely be grilled on the impacts of trade, but he’ll have to take a wait and see approach there, while noting there are risks to the downside. Look for some Senators to ask about the yield curve too, and whether it’s a harbinger of a recession. We suspect he will note past such occurrences, but can suggest this time is somewhat different.

Significant levels to be watched ahead of Fed Chairman’s Testimony:

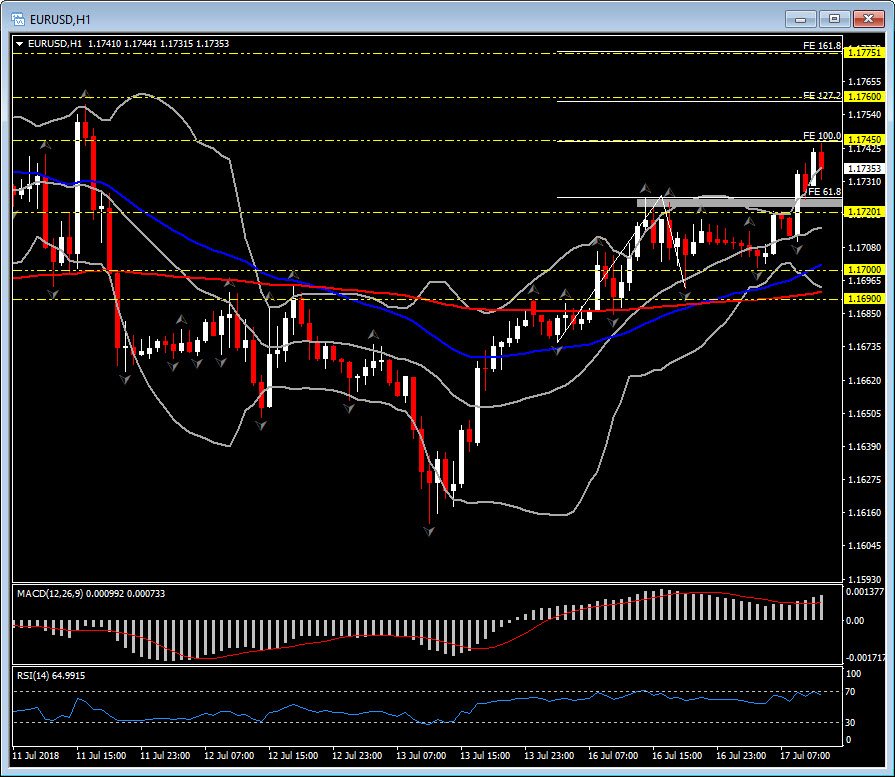

EURUSD found Support into the 1.1690- 1.1700 level through the morning. The lack of fireworks from the Trump/Putin meeting helped the USD slightly, though Fed Powell’s testimony today weighs on Greenback and resulted on boosting EURUSD higher up to 1.1741 after London open. The pair remains above the latest up fractal at 1.1730 for a 3rd consecutive hourly session. In general it is trading to the upside, after breaking above the 1.1690-1.1740 range earlier. The Intraday momentum indicators suggest further upwards momentum within the day, with RSI at 68 and MACD holding above signal line and within positive territory since Friday. A close of the hourly candle above the 1.1740 barrier could result in further buying up to FE127.2 and FE161.8, at 1.1760 and 1.1775 respectively. Short term Support at 1.1720.

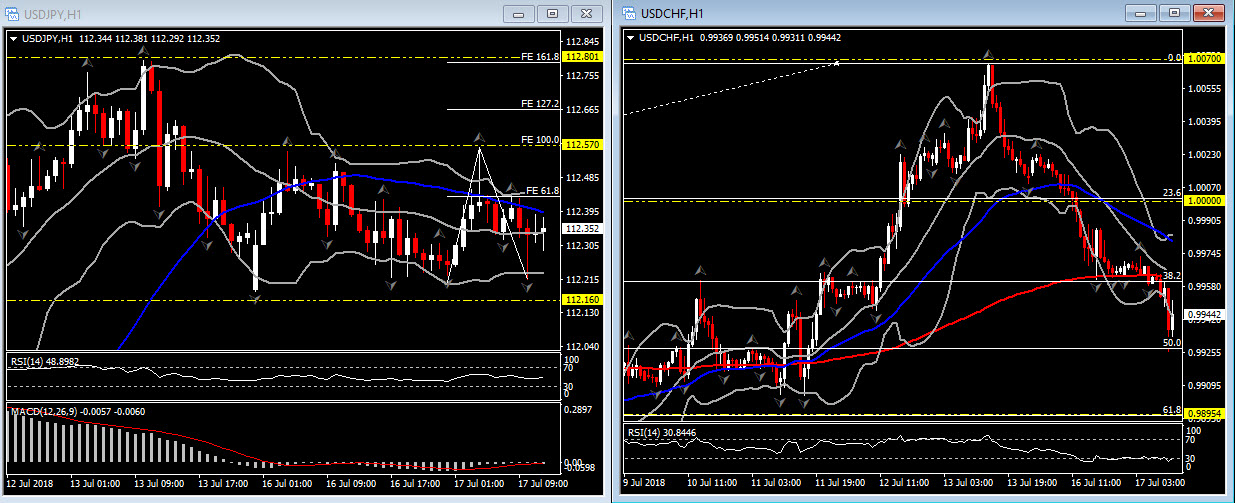

USDJPY has been confined to a 30-point trading range since the London open, stuck between 112.21 and 112.57, and remaining under Friday’s six-month high of 112.80. Momentum indicators are neutral as RSI is consolidating within 45-54 range and MACD is close to zero zone. Therefore by applying the Fibonacci extension on today’s hourly reversal, the immediate Resistance has been set at 112.43 and support at today’s low fractal, at 1.1216. A breakout above Resistance could result to a swing high up to today’s peak and FE 100.0 as well, at 112.57, and even higher up to Friday’s peak at 112.80

USDCHF has confirmed an evening star formation pattern in the daily chart, which consider be a strong bearish pattern. Additionally, the pair is currently just a breath away from the 50% Fib. retracement level since June’s incline up ti 1.007. This could provide support to the pair and it is likely to see a rebound on this level up to the 1.000 level. Otherwise, a continuation to the downside suggests the retest of 0.9890 level, which is at the 61.8% Fib. level.

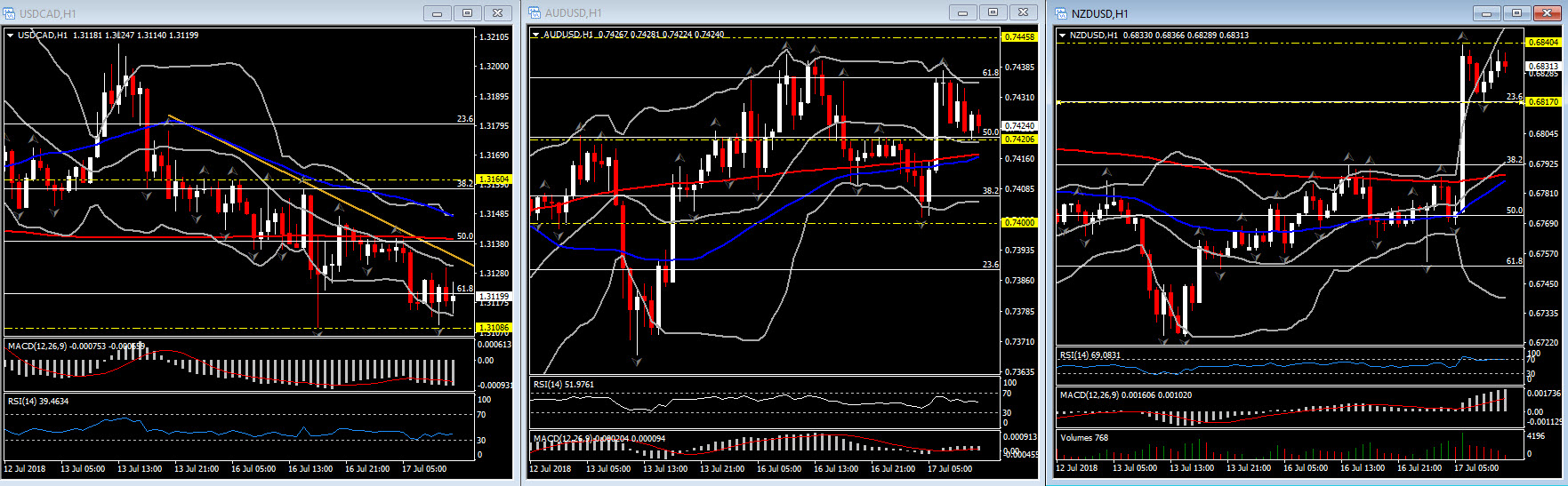

AUDUSD: Aussie perked up today up to 0.7437, while it is trading for 7 consecutive hourly sessions above 20-period MA. Hence a break below immediate Support, which is the 20-period MA at 0.7420, should drift the pair lower to 0.7400. Resistance comes at 0.7435.

USDCAD has remained heavy after yesterday printing a 4-session low at 1.3110. The weightiness of the pairing reflects general weakness in the US Dollar, and comes despite the sharp retreat in Oil prices yesterday and in recent sessions. The BoC hiked interest rates by 25 bp last Wednesday, and guided markets for tighter monetary policy to keep inflation near target met expectations, though the statement emphasized a “gradual approach, guided by data.” USDCAD has Support at 1.3087-90, which encompasses the current position of the 50-day moving average (i.e. at 1.3040), and Resistance at 1.3130. A break above Resistance could retest the Yesterday’s peak at 1.3160.

NZDUSD: The NZ Dollar rallied on the back of perky inflation data, with New Zealand core CPI lifting to a seven-year high rate of 1.7% y/y. NZDUSD rallied over 0.5% to a 5-session peak of 0.6840. It is currently holding above latest swing low at 0.6817, while Resistance is set at today’s high at 0.6840.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/17 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.