USDCAD, H1

CPI is due today at 12:30GMT and it is expected to dip 0.1% (m/m, nsa) in May after the 0.1% rise in May. The CPI is projected to grow at a 2.2% y/y pace in June, matching the growth rate in May and April. Gasoline prices fell about 2% in June (m/m, nsa), which drives our projection for the 0.1% dip in total CPI during June. Additional factors include auto prices, which have seen substantial declines over the past three months and could continue to decline in June.

Meanwhile, Retail Sales are expected to rebound 1.0% in May after the 1.3% drop in April. The ex-autos sales aggregate is projected to rise 0.5% in May after the 0.1% dip in April. The culprit behind the total sales decline in April was motor vehicle and parts dealers, which saw a 4.3% drop in April. Statistics Canada blamed poor weather as a suspect for the sales tumble during April, noting that Ontario, which was the source of most of the decline in motor and parts dealers, saw cooler than usual conditions in April, with freezing rain featuring in the middle of the month. We expect a rebound in May. CPI’s gasoline price index grew 3.3% in May after the 6.8% drop in April. Hence, gasoline station sales should provide a boost to total and ex-autos sales retail sales.

BoC has maintained that an unwinding of temporary factors is boosting CPI. They note that it is important to look at core CPI. Hence the core CPI measures is expected to hold at 1.9%, which is consistent with BoC’s view on inflation. Also, BoC’s Q2 outlook survey revealed that inflation expectations remain inside BoC’s 1-3% control range, albeit with a drift to the upper half of the band.

The main consideration is that they can tolerate some heat on the CPI numbers given the economy is finally in expansion mode. Better growth opens up more capacity (via investment and increased labour force participation), allowing them to tolerate faster inflation growth than they usually would.

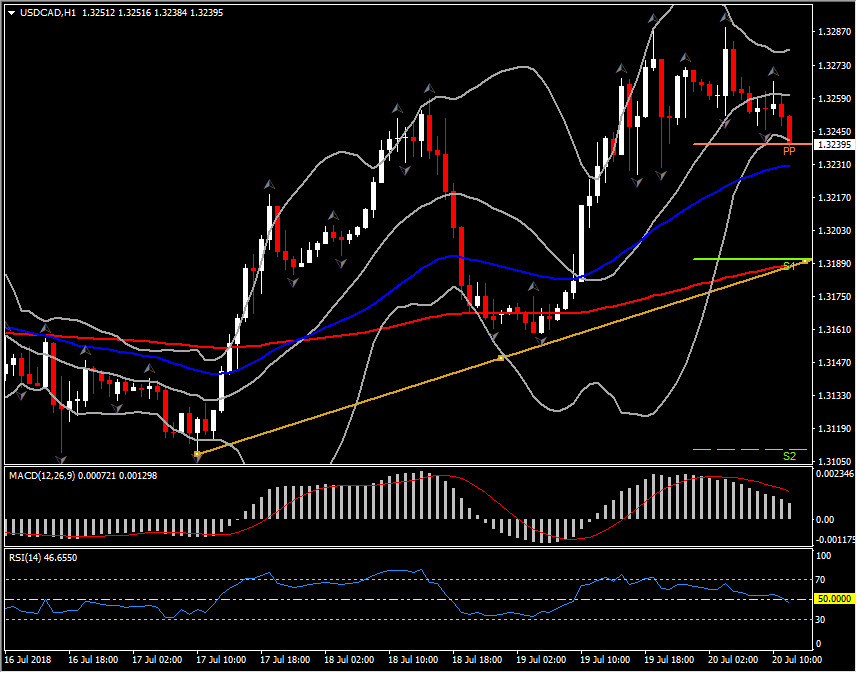

Currently on the anticipation of the data, the Canadian Dollar is getting stronger with USDCAD moving lower. It is trading at the 1.3240 from the 1.3288 high this morning. Support levels hold at 1.3240, 1.3186 and 1.3106. Resistance levels come at 1.3260, 1.3290 and 1.3320.

Daily Support is set at the upside trendline, at 1.3200, while Resistance come at 2 days high at 1.3290.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/24 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.