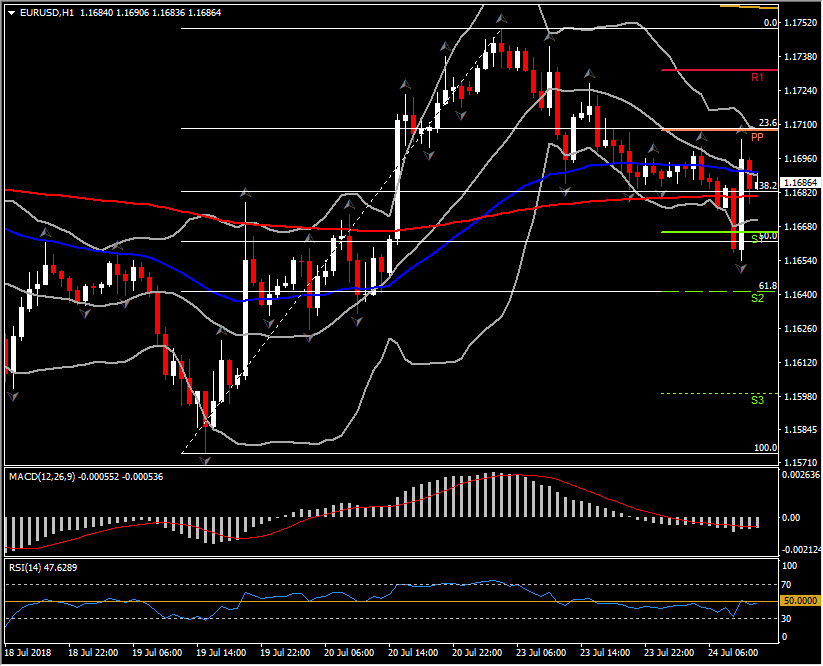

EURUSD, H1

EURUSD has turned lower after failing to sustain rebound gains above 1.1700, leaving a high at 1.1704 before ebbing under 1.1680. A 2-session high, pegged during the early London session, is at 1.1654, and the pair has an overall heavy tone.

Euro sellers were provided a cue by sub-forecast preliminary July PMI survey data out of the Eurozone, where the composite reading fell to 54.3 from 54.9 in June. The survey painted an overall downbeat picture, while growth remained at relatively robust levels, order inflows weakened and businesses reported a decline in their expectations for future activity. This provides a contrast to profuse market speculation for an upside surprise in US Q2 GDP data in the advance release due Friday, which has been fuelled by a tweet yesterday from Charlie Gasparino of Fox News, who reported an @WhiteHouse sourced “scoop” that it is touting nearly 5% growth (versus the median forecast for 4.1% and after the 2.0% growth of Q1).

Taking a step back, EURUSD remains in a choppy, sideways range that’s been unfolding for nearly two months now. The relative strength of the US economy and the Fed’s tightening course tips the balance of directional risk toward the downside, though President Trump’s verbal interventions in Fed policy and forex rates is making the field tactically more challenging for Dollar bulls. Across the pond there are other wildcards; one stemming from the still-evolving populist political landscape in Italy, and another being the prevailing sense of risk for there being a no-deal Brexit scenario, with both carrying potential to disrupt the EU pa.

EURUSD remains in the negative bias intraday as it has failed 3 times today to break above the PP level at 1.1707, which is also the 23.6% Fibonacci retracement since the July 19 rally. Meanwhile, momentum indicators present the continuation of negative momentum for the pair, as RSI remains below 50 and MACD lines move southwards above signal line and below the zero line.

Resistance is at 1.1707, and Support at the S2 which coincides with 61.8% Fib. level at 1.1640. A breakout of the Support will open the way towards last week’s low, i.e. 1.1575-1.1600.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/24 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.