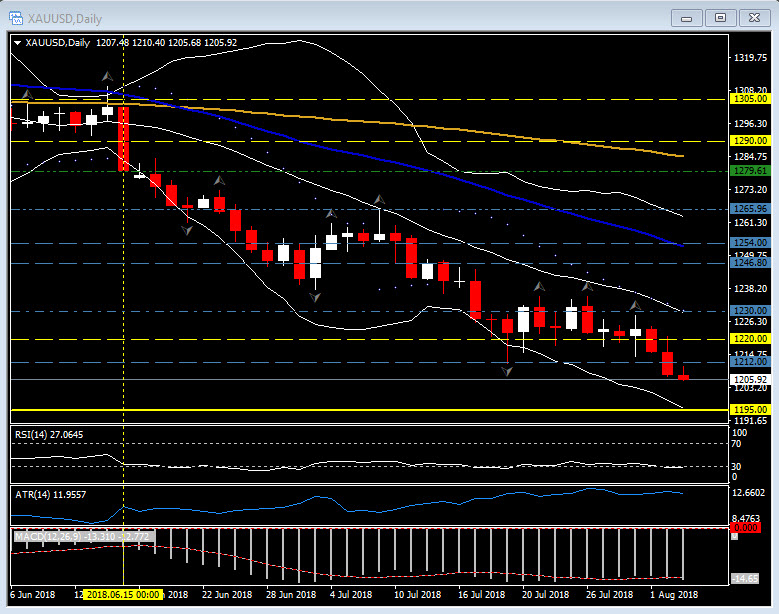

XAUUSD, Daily

The old English saying, derived from the Bard himself, and the Merchant of Venice, has summed up the last three months for the precious metal. XAUSD closed below $1220 on Wednesday for the first time since June 2o17, and then yesterday closed below a key weekly support area at $1212.00. A close below here today will add to the already significant bearish sentiment for this key commodity. The monthly chart also continued its move lower. The break of the 50 and 20-period moving averages ($1269) in June was confirmed during July with the break of the Fractal low from January. The next monthly low sits at $1195 (March 2017), $1170 (November 2016) and $1150 (December 2016). The RSI at 27 is oversold but has been pivoting around the oversold zone from the significant fall on June 15. The rise in the ATR and decline in the MACD are both still intact although also showing signs of exhaustion. On the daily chart the $1205 and then the psychological $1200 level are the next key levels.

A move to the north would require a breach and hold of $1230 and the 20-day moving average and some signs of a weakening USD. As US-China trade tensions rise and with the FED on course for two further rate hikes this year, the demand for non-yielding Gold remains weak.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/07 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.