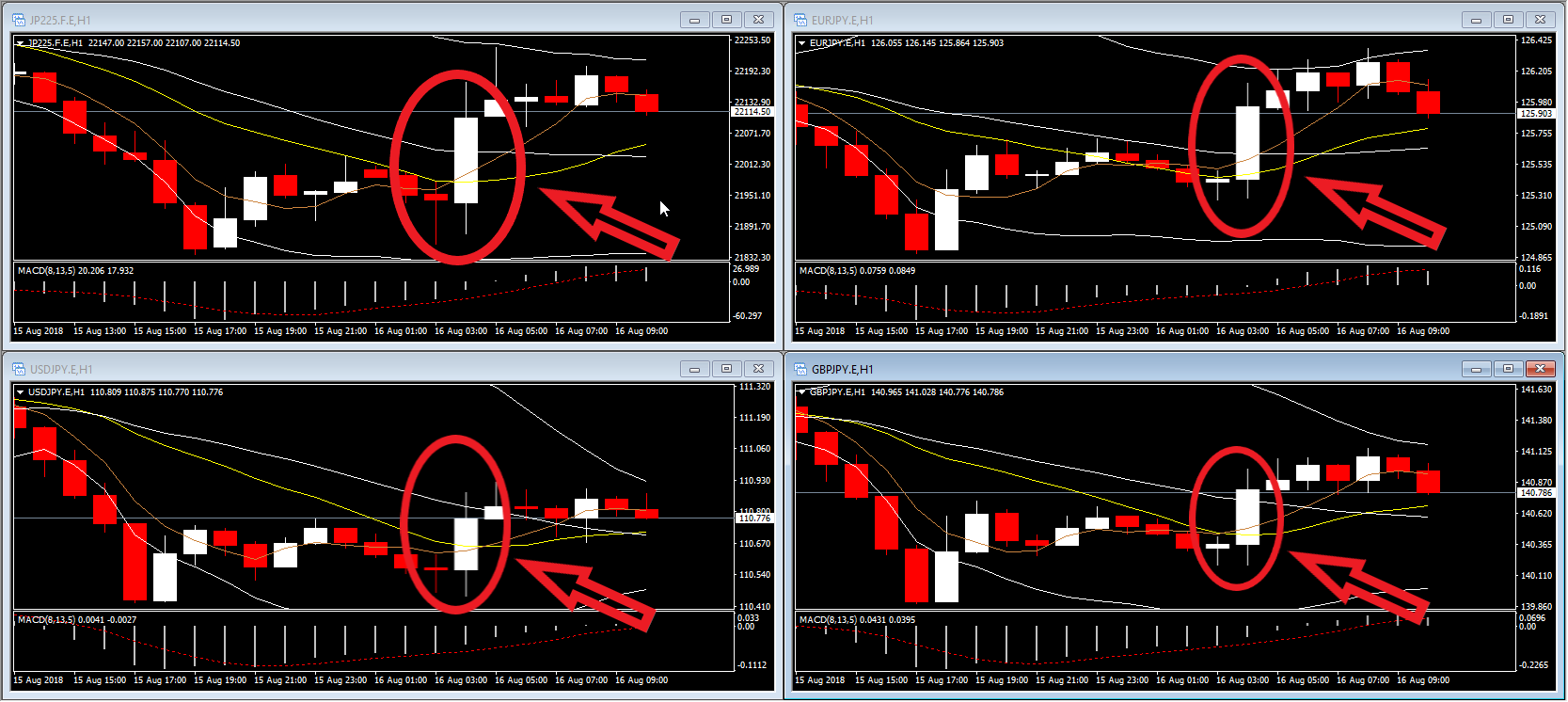

USDJPY, EURJPY, GBPJPY and JP225, H1

The latest data release has not been good for Japan. The trade deficit has worsened to YEN231 bln, compared to the consensus expectation of YEN50 bln.

According to economic theory, trade is an important determinant of exchange rate behaviour. The rationale is simple: by buying local products, foreigners are essentially offering their currency. For example, a European would need to offer Euros for the purchase of a Japanese car. Let’s assume that the car is worth EUR15,000. This means that the quantity of Euros in the international market, i.e. the supply of Euros, would increase by exactly EUR15,000. As per standard economic thinking, an increase in supply means that there will be a corresponding decrease in the price. Price, in this example, is the EURJPY exchange rate. Hence, the increase in the quantity of Euros would mean that there is more supply for the existing demand and the Euro should depreciate with respect to the Yen.

A country’s trade balance shows exactly this: how much the country has sold abroad and how much it has purchased from abroad. If it is positive, then this suggests that the country has sold more goods and services than it has purchased, meaning that there is more demand for its currency than there is supply. In FX terms, a positive trade balance (surplus) signals a potential strengthening of the country’s currency. The opposite also holds: a negative trade balance (deficit) suggests that there is more supply of the currency than there is demand, and this signals a potential weakening of the currency. As expected, the larger the deficit or surplus, the larger the move in the exchange rate due to the larger change in supply.

Given the importance of the trade balance, experts aim to provide a forecast on its future values. In the HotForex Economic Calendar this is reflected in the column denoted “Consensus” which indicates the average of many forecasts. Given the prediction, traders tend to discount this information: if the forecast suggests that a country’s trade balance will be negative this is factored in the current price. Naturally, given the fact that this is just a forecast, most traders do not factor in the whole effect and hence the term “discounting”.

There are, of course, times when forecasts are imprecise. Despite expecting, say, a USD20 bln trade deficit for the US, actual numbers may show a USD10 bln deficit or a USD30 bln deficit. In this case, traders usually adjust their view of the currency when the announcement is made public. If the trade deficit was less negative than expected (e.g. USD10 bln) then the USD would most likely see an appreciation given that supply of currency was less than anticipated. In contrast, if the trade deficit was more negative than expected (e.g. USD30 bln) then the USD would most likely depreciate since the supply of Dollars was more than anticipated.

Returning to the first sentence of this article, let’s put the above into context: traders and experts anticipated a smaller trade deficit (YEN50 bln) than the actual (YEN231 bln). This is also reflected in the path of exports which increased by much less (3.9%) than expected (6.3%). Imports also increased slightly more than expected. This means that the supply of Yen in the market is higher than expected and this should depreciate the currency’s value.

This is exactly what happened in the USDJPY, EURJPY, and GBPJPY pairs which recorded a depreciation in the Yen. In particular, EURJPY recorded the largest increase, at 0.41%, GBPEUR increased by 0.31%, while USDJPY increased by 0.19%, all within an hour of the announcement. The shift in the price appears to be rather persistent in all pairs.

A question which may arise relates to the reason the reaction is smaller or larger according to the pair. As you may have guessed, the magnitude is mostly based on the other currency’s trade balance. Given that the Euro area’s trade balance records a surplus, it means that the supply of Euros was already lower and hence a larger reaction could be expected. The UK, in contrast, has been dealing with increasing trade deficits in the past years, also a result of the depreciation of the Pound following the Brexit decision, while the US, which records probably the highest trade deficits in the world, registers the smallest reaction.

Does a trade deficit always signal trouble? Not in every occasion. A trade deficit could also mean that the domestic economy is growing enough to consume more than it produces or, in other words, it needs to import goods for consumption. Higher imports mean higher consumption and higher consumption leads (eventually, albeit with some lag) to improved firm profitability. This suggests that the value of companies will increase and as a result stock prices would also rise. This is evident in the behaviour of the JP225 which rose by 0.73% within an hour of the announcement. Note that a continued, long-term, trade deficit can lead to some trouble but we will leave this for another analysis.

So let’s sum up what this article is all about in a couple of sentences: a worse-than-expected trade deficit is usually bad for the currency and usually good for the stock market. The extent of the effect depends on the extent of the difference between the actual and the forecasted values, as well as to the other currency’s trade balance.

Remember though, that other economic announcements could take place at the same time and have an impact on the exchange rate to either the same or the opposite direction. As such, one needs to be careful when estimating the effect of an announcement on the exchange rate.

Click here to access the HotForex Economic Calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/21 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.