USDJPY, H1

The larger than expected US trade deficit widening to $50.1 bln in July, followed downward revisions in all the 2018 trade deficits, leaving oscillations below a revised $55.0 (was $55.5) bln cycle-high in February. The July gap was $0.3 bln wider than indicated by the “advance” trade report thanks to a larger downward revision in exports than imports. A boost in Q2 GDP growth to 4.3% is expected from 4.2%, with a $1 bln offsetting downward bumps for both exports and imports, alongside a $3 bln boost in construction. The GDP is expected to growth of 3.5% in Q3, with a $51 (was $48) bln net export subtraction after a $58.6 bln addition in Q2.

Meanwhile, the real export is anticipating a growth of -3% in Q3 after an estimated 8.9% (was 9.1%) Q2 surge, and a 4% Q3 growth rate for real imports after a -0.5% (was -0.4%) Q2 clip.US goods exports fell in July after robust Q2 levels thanks partly to efforts to ship goods before new tariffs. Strength was seen in Q2 exports of food and capital equipment before July declines, while consumer goods exports fell into June and July after elevated levels since February. Consumer goods imports posted a July drop after a June pop.

Therefore, a widening in the current account deficit to $112.3 bln has been forecast in Q3, after falling to an estimated $103.3 bln in Q2 from $124.1 bln gap in Q1 that is likely to be revised lower. An annual current account gap of $447 bln is expected in 2018, after a $449 bln expansion-high in 2017.

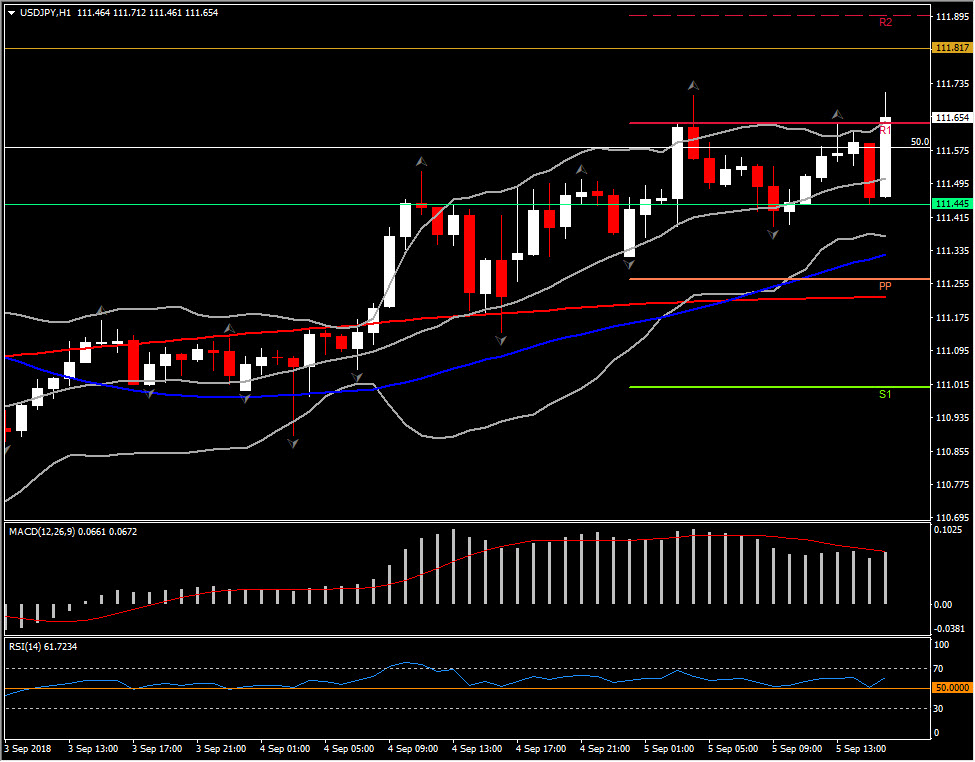

The Dollar was little changed after the in-line trade report, however politics where the ones that have driven the market in the last hour. Treasury yields and USDJPY have bounced up to 111.70 with those of bunds and the Cable after reports that the UK and Germany have dropped key Brexit demands.

The Cable rallied 150 points to just under 1.2980 on Bloomberg reports that Germany has agreed to drop key Brexit demands, perhaps paving the way to a deal. Germany is apparently set to accept a less detailed agreement. The Cable had bottomed at 1.2786 into the NY open.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/06 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.