GBPUSD, H1 and H4

The British government has been angling for a Brexit that leaves the UK with a close relationship with the EU, though given the steadfast redlines of the EU, not to mention the opposition of the small but significant cabal of Brexiteer MPs, the only way this could move forward would be if the British government concedes its proposal for a UK-EU single market for goods and agricultural products in place of a free trade agreement.

The main obstacle in this scenario, however, is the Irish border issue — that is, how to maintain the political imperative for a free-flowing border. Dublin and the EU poured cold water on ideas to solve this issue that were unveiled by the pro-Brexit European Research Group yesterday. The softest Brexit option would see the UK exiting the EU but remaining in the EEA (European Economic Area), similar to the Norway model, but unless the UK maintains membership of the customs union (which Norway doesn’t), it won’t satisfy the Irish border problem. The political viability of this option in the UK is questionable as the Labour Party has rejected it while the Brexiteer cabal is staunchly against it.

The UK is likely to end up with a defacto pro-Canada-plus type of deal with the EU (i.e. a more traditional third-country free trade deal with added benefits), although the government’s official position remains against this. Another referendum would be one way to break the political deadlock. The option of leaving the EU without a new deal is unlikely; a scenario that the UK parliament will work hard to prevent.

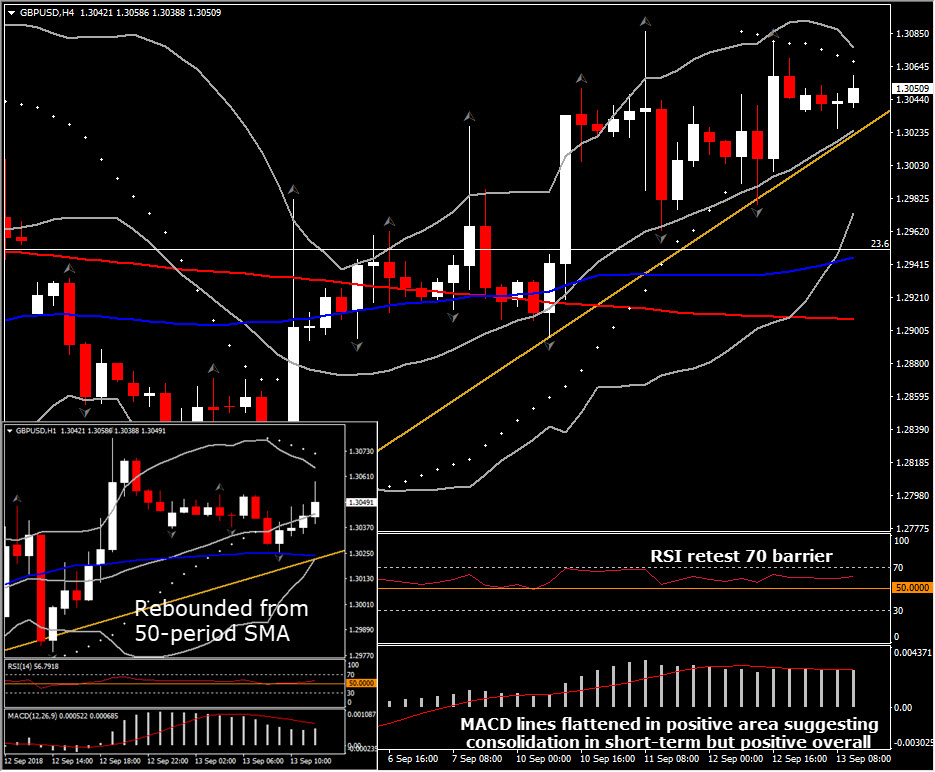

Moody’s warned about a no-deal Brexit scenario, which barely caused a ripple, as the risks are well known and the UK parliament and EU member states will make it their high priority in avoiding such an eventuality. So far today, the Pound is trading with little directional bias, presently sitting at near net unchanged levels versus the Dollar and Euro while showing a modest loss to the underperforming Yen. The Cable has settled above 1.3000 after recent bouts of Brexit-related volatility, holding below recent highs at 1.3085-88.

The Sterling is expected to remain in turbulence airs for some time yet, while, following today’s BOE meeting, is likely to remain unaffected overall, as no changes are expected to settings or guidance at this juncture. The Cable has intraday Support at 1.2992-95 and intraday Resistance at 1.3085-88.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/13 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.