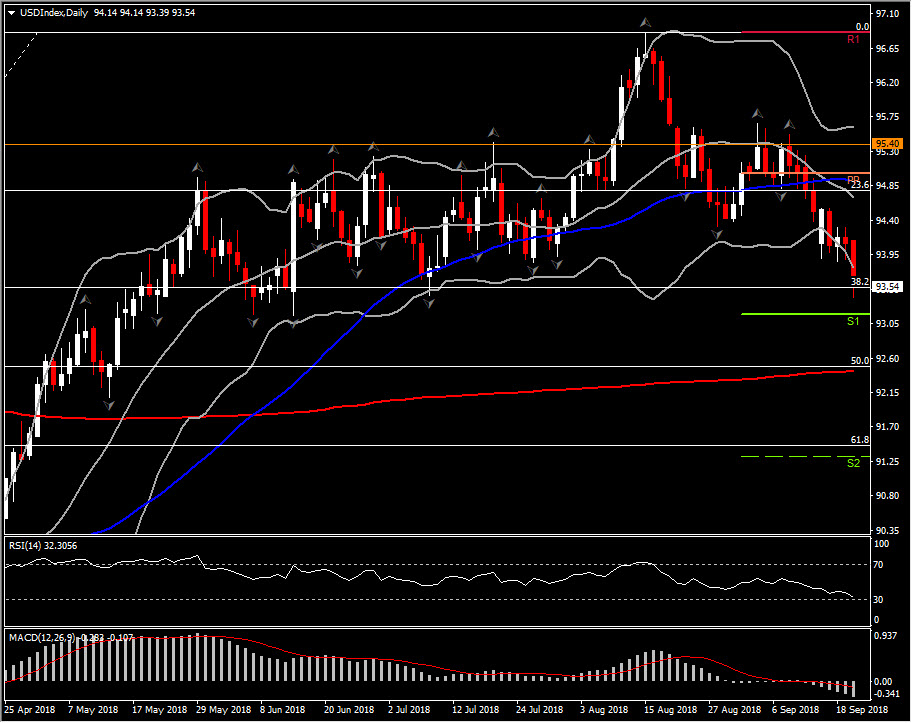

USDIndex, Daily

The Philly Fed bounced to 22.9 from 11.9 in August but a higher 25.7 in July, versus a 19-month low of 19.9 in June and a 1-year high of 34.4 in May. The ISM-adjusted Philly Fed rose to 56.5 from a 1-year low of 56.1 in August but a higher 59.7 in July, versus a 45-year high of 62.5 in May. We saw gains in every component but inventories and prices, with a big new orders pop after a big August drop. Monday’s Empire State headline fell to a 5-month low of 19.0 in September from a 10-month high of 25.6 in August and 22.6 in July, versus a 3-year high of 28.1 in October 2017. The components were stronger than the headline for that measure, and the ISM-adjusted measure fell only slightly to 55.9 from 56.4 in August but a lower 54.6 in July, versus a 12-year high of 57.9 in June. For later September surveys, we expect a Richmond Fed drop to 19.0 from 24.0, a Dallas Fed drop to 30.0 from 30.9, a Chicago PMI decline to 62.0 from 63.6, an ISM drop to 59.0 from a 14-year high of 61.3, and an ISM-NMI drop to 58.0 from 58.5. The mix should allow the ISM-adjusted average of the major surveys to slip back to 58 from a 59 cycle-high in August, as seen in May and June, versus 57 in July. The average has oscillated in the 57-59 range since September of last year.

US equities are on the mend as short-covering in the tech sector helped lead the FAANG group higher, along with chip makers. The Dollar Index sank 0.65% to 93.39 as stronger than expected data are helping overshadow and defy trade angst.

The USDIndex has broken over a key Support level at the confluence of the 3-month low and the 38.2% Fibonacci retracement level from February’s rally. A closing below this level today could suggest further decline for the Index. Next stop is the cluster of the 50% Fibonacci level and the important 200-day simple moving average, around 92.40-92.50 zone. A breach of both this level and 91.50 and 90.50 would become realistic. Intraday Support is now offered by S1 and the 3 down fractals printed in May and June, at 93.15.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/25 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.