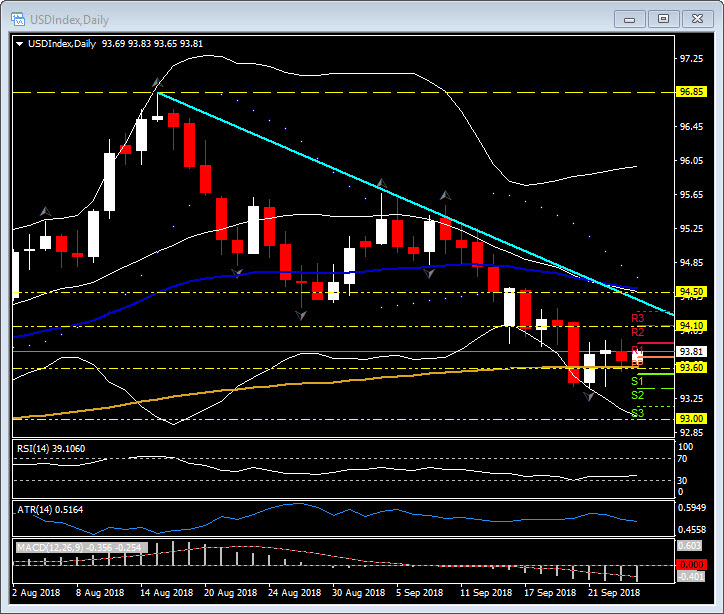

USDIndex, Daily

The Dollar could be in for a fall should the Fed trim guidance on the extent of tightening. The USDIndex has already declined by a sum total of about 3% in five out of the last six weeks, pulling back from the three-month peak that was seen in early August at 96.85. The Fed announces today at 18:00 GMT, with the expected 25 bp rate hike to be accompanied by the central bank’s new estimates with 2021 added. At 18:30 GMT Chairman Powell will give his press conference. While a quarter point hike is fully anticipated, along with indications that another tightening is likely at year end, of importance will be the dots and what they suggest about the rate trajectory in 2019, 2020 and 2021. At the last FOMC in June, the Fed suggested four tightenings this year, three in 2019 and one in 2020, with a 2.875% long-run rate (2.25% to 3.5% range).

The suspicions are that the FOMC will maintain this view, but the ranges could be narrowed from the above given uncertainties over growth and as policy approaches “neutral.” This in turn could knock both Treasury yields and the Dollar lower.

The USDIndex has key support at 93.60 (daily 200 day moving average) and 93.00 (weekly 200 day moving average). Resistance sits at 94.00-10 and 94.50 (daily 50 day moving average).

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/26 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.