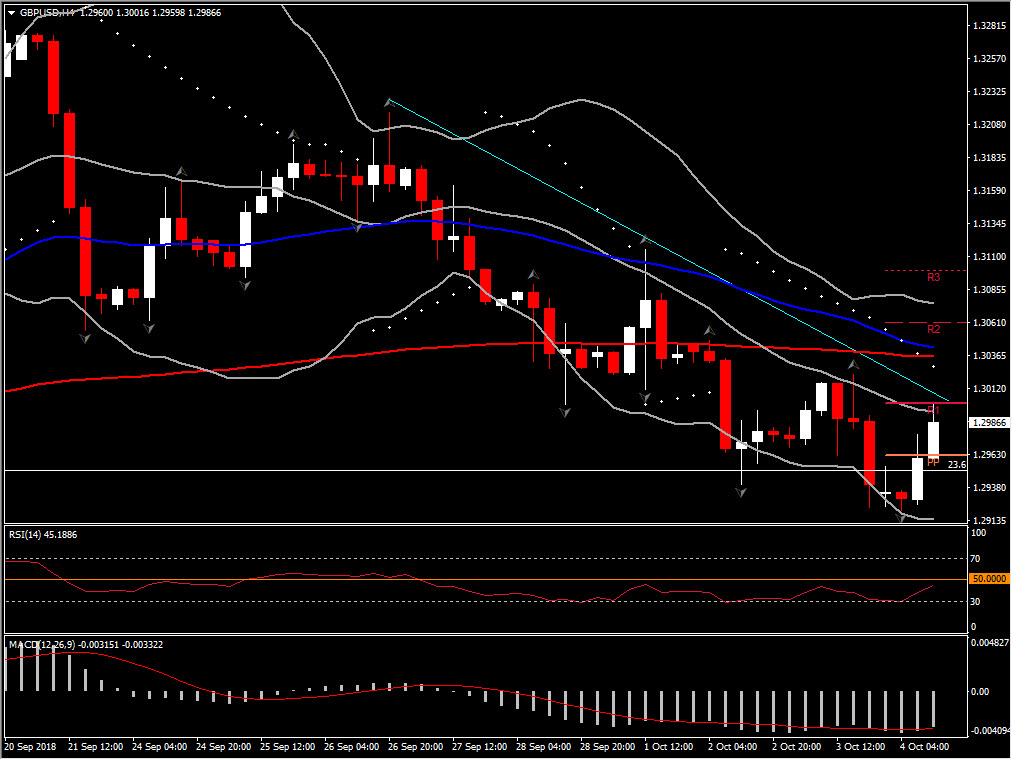

GBPUSD, H4

The Conservative Party’s annual conference has come and gone, but the cloud of uncertainty over Brexit remains. There is no certain view on what form Brexit will take, and whether, even, the UK and EU can avoid the spectre of a no-deal scenario. Nissan, which is a major manufacturer in the UK, has today become the latest in a long list of businesses and other EU government’s to warn about the consequences of the UK leaving the EU without a new agreement on trade.

One thing that has become clearer is that the Prime Minister May looks, for now, to be safe in her position, with those MPs plotting to replace her with Boris Johnson (or others) proving to be lacking sufficient numbers at this time. However, May’s Brexit plan (AKA the Chequers plan) remains in jeopardy, with the Eurosceptic members of her party plus North Ireland’s DUP (which carries the king making votes for the Tory Party) remaining steadfastly opposed to it. Things will come to a head at the EU leaders’ conference later this month, as the EU is likely to reject the Chequers plan in its current form, and the UK’s parliament vote in November or December.

Focus in the meantime will be on the negotiation process. The government has an emerging plan to remain in the customs union to overcome the Irish border problem.

Hence her Majesty’s currency upside potential remains curtailed with Brexit issue likely to remain in a rut unless an Irish border backstop solution (that guarantees a free-flowing border between Ireland and Ireland in whatever Brexit scenario) can be found. The need for a backstop, to recap, is agreed by both the EU and UK, but where fundamental differences in how to achieve it is blocking progress needed to complete the negotiation on divorcing terms. A breakthrough is needed to allow divorce terms to be settled, which in turn would allow a two-year transition phase to be confirmed and allow time for the UK and EU to hammer out post-Brexit a trade deal.

Today, Cable has lifted back above 1.3000, putting in a little distance from yesterday’s 3-week low at 1.2922. The low was a product of US Dollar gains, and the rebound is now a product of a Dollar correction, with the Pound trading relatively steadily against the Euro, Yen, and other currencies. Cable has trend Resistance at 1.3000 and 1.3045-1.3060. Support at 1.2960 and the next one is at 1.2920.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/09 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.