The Rio Tinto Earnings Report is out on Tuesday, October 16, 2018 with expectations suggesting that this will be a good year for the mining giant. The Reuters survey of analysts suggests that they hold an overall positive view of the company, with only 3 out of 26 analysts reviewed suggesting that earnings should underperform the market. The overall positive outlook of the company is also seen in the annual forecasts, which expect sales to rise by approximately 9% compared to the 2017 figure. Earnings Per Share (EPS) are also expected to rise, with average expectations suggesting that they will reach $4.92, compared to $3.71 a year before.

The Nasdaq pool of analysts suggests that the company is a Buy recommendation, with just one analyst suggesting selling it. Consensus EPS forecast is lower than the Reuters one but still estimating it to rise to $4.59, at a P/E (Price over Earnings) ratio of approximately 10. Similarly, Yahoo!Finance suggests that recommendations average at Buy, with no sell recommendations by analysts. The major investment banks (Goldman Sachs, JP Morgan, HSBC) have upgraded their views regarding holding Rio Tinto stock and suggest that portfolios should add more weight to the firm. Vuma consensus estimates, on the basis of the forecasts made by 15 analysts are also suggestive of a continuous increase in the quantity of mining output.

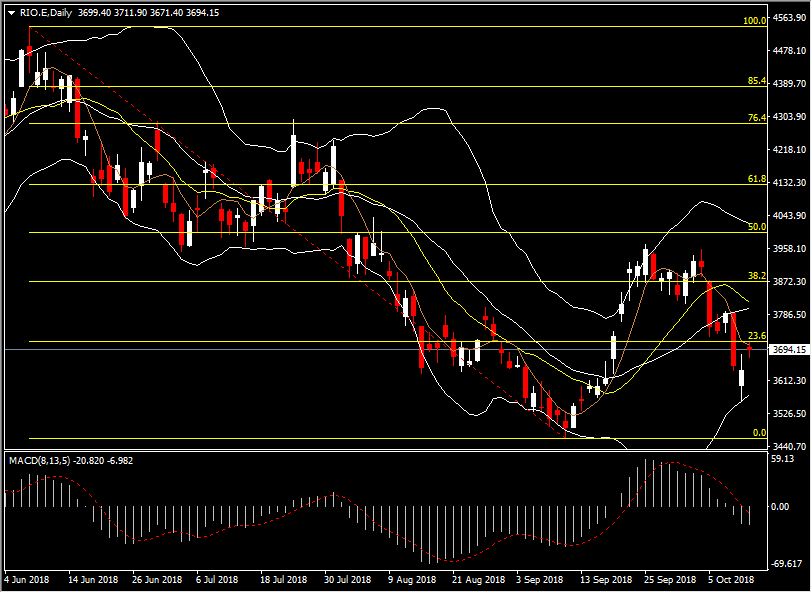

Technically, the Rio Tinto share came of two tops at approximately 3970, and then returned to lower levels. The current price is trading at approximately 3690, just below the Fib. 23.6% level of 3714, which could prove to be a Support level if the stock surpasses it, heading to the new Resistance level of 3875 (Fib. 38.2%). On the downside, the Fib. 0% support level of the September low stands at 3461.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/16 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.