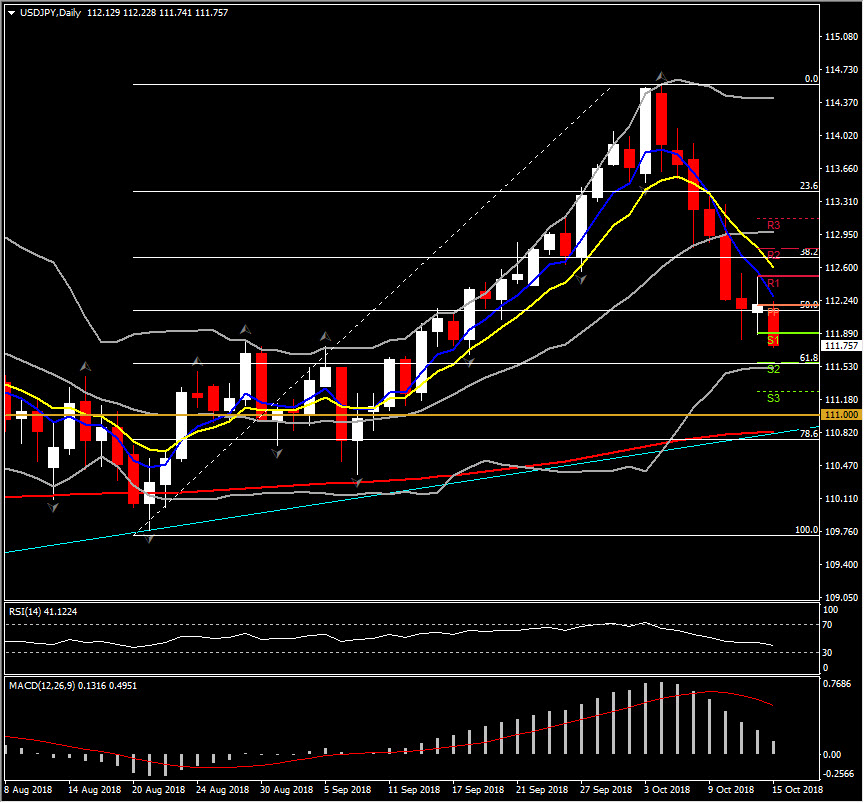

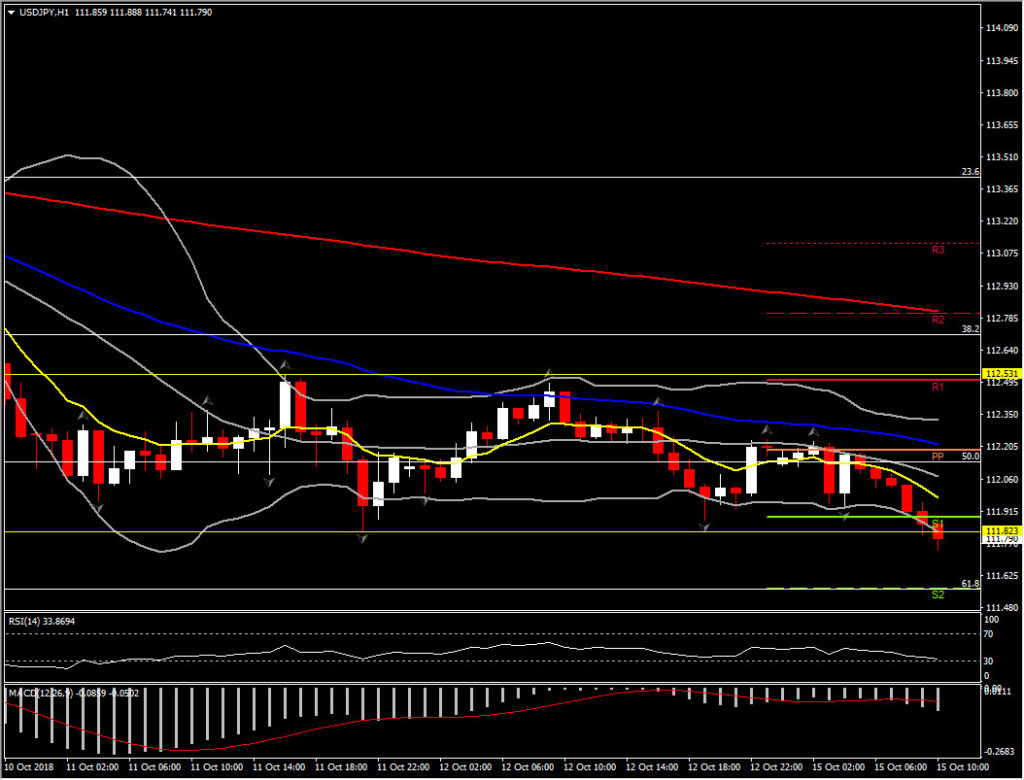

USDJPY, H1 and Daily

The Yen has traded moderately firmer, underpinned by a resumption of risk aversion in Asian equity markets. USDJPY has drifted below Friday’s 111.82 low, while it is showing a 0.7% loss to the Pound and 0.4% loss to the Dollar, Euro and Canadian Dollar. This is now the third consecutive session the pairing has hovered around the 112.0 mark. It has been a negative session for Asian stock markets so far, though there has been limited safe haven demand for the Yen as yet. Japan’s Nikkei 225 is down 1.8% heading into the Tokyo close, breaching last week’s low, while China’s SSE index is 0.6% for the worse, so far remaining above last week’s lows.

The usual suspects have been weighing on Equities, as relayed in circulating market narratives — US-China trade war and higher US and global yields (although softer today). In data, Japan’s August industrial production was revised to 0.2% m/m growth, down from the preliminarily estimated 0.7% m/m and decelerating from 0.6% growth in the month prior. Overall, for USDJPY, the directional risks remain to the downside without looking overextended yet.

The asset has been sharply driven by the bears for the last 6 consecutive hours, with the latest candle formed below the S1 and below the lower Bollinger Bands pattern, which is extended to the downside. The price is also moving below all EMAs, i.e. 10- , 20-, 50- and 200-period EMAs. The sellers are also gathering momentum once more with the MACD oscillator accelerating lower below its signal line within the negative area. RSI is slightly above the 30 barrier, but its slope is looking downward.

Subsequently, the downwards momentum has not run out of steam yet, since we have not identified any significant reversal indication. Only an upwards correction above 50-period EMA, at 112.18, could provide an indication for a possible retest of 112.50 level. However, in the medium term, only a break above 112.54-112.60 area, which was the upper area of 2-day range and 10-days EMA, could strengthen the possibility of the asset reversing to the upside, after October’s sharp decline.

Intraday Support levels: 111.57 ( Strong Support as it coincides with S2, 61.8% Fib. level and lower daily BB) and 111.25, 111.00

Intraday Resistance levels: 112.18, 112.50, 112.80

In general, the outlook remains bearish since October 4, given the risk for a sustained period of risk aversion in global markets, which could in turn generate safe haven demand for the Yen and offset otherwise bullish USDJPY fundamentals.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/15 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.