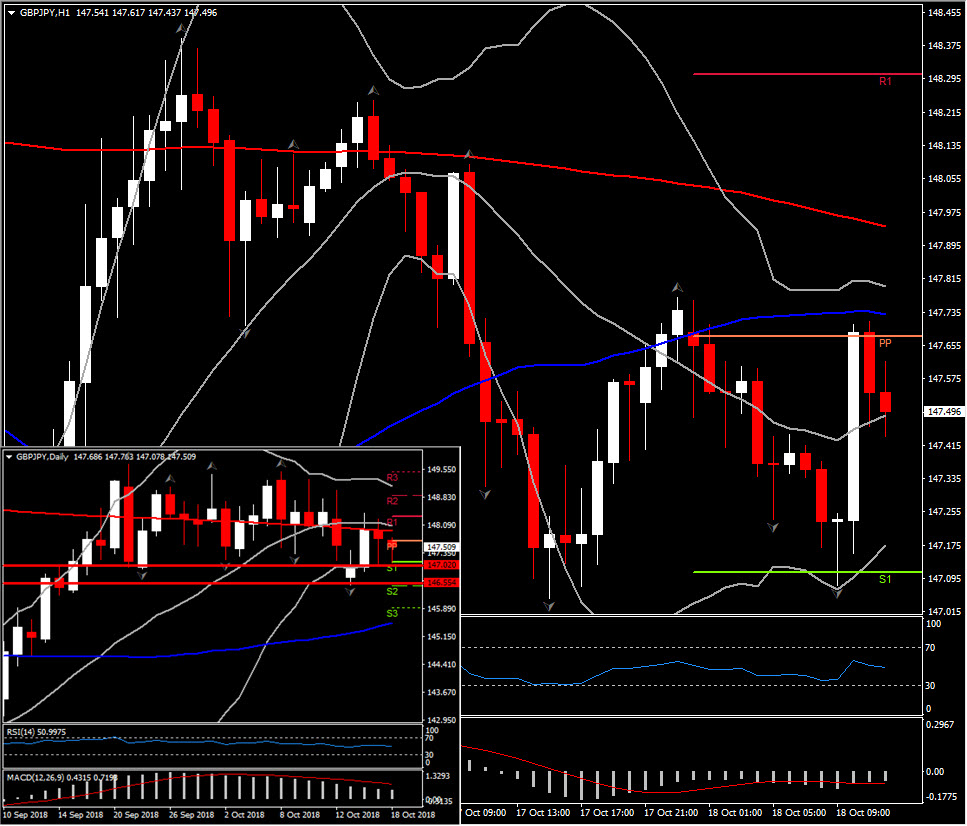

GBPJPY, H1 and Daily

UK September retail sales disappointed, contracting by 0.8% m/m after rising by 0.4% in August. The median forecast had been for a 0.4% m/m decline. The y/y figure rose 3.0% y/y, down from 3.4% y/y growth in the month prior, and below the median forecast for 3.6% y/y. A 1.5% m/m decline in food store sales, the biggest m/m drop in this category since October 2015, drove the headline m/m contraction. The data, while disappointing, has had minimal market impact.

This week’s data has seen perkier than expected August wage data offset by sub-forecast readings in CPI and Retail sales, which, along with the significant uncertainty on the Brexit front, should keep the BoE on hold with a view to tightening further down the track. Tightening could support Sterling ahead of Brexit risks.

Meanwhile today, Sterling has continued to hold up, with portfolio and reserve managers remaining sanguine to the risk of a no-deal Brexit, although the risk of a cliff-edge departure seems more tangible after the EU-17 cancelled the special summit for Brexit that had been earmarked for mid November. The president of the European Commission Tusk called on the UK government to come up with creative solutions to solve what has increasingly seemed an insoluble Irish border problem. The EU left the door open to a special summit should progress be made, and offered the carrot of a longer transition period, although the major known unknown is whether Prime Minister May can reach a deal with the EU that would in turn find sufficient support at a House or Commons vote.

There remain 5 different possible scenarios: a no-deal Brexit, a Canada+ type of hard Brexit, a Chequers-plan Brexit, a Norway-model style soft Brexit, and a let’s-call-the-whole-thing-off option, whereby the UK decides on remaining in the EU (which could only happen after a new referendum or general election). May has continued to push an evolved version of her so-called Chequers plan, which looks to be a no-go for the EU (crossing red lines by demanding cherry-picked access to the single market), while the Canada+ option, like Chequers, would be dogged by finding a solution to the Irish border problem.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/18 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.