Yesterday Netflix announced that it will return to the markets with a $2 bln junk bond offering. Essentially, the company, aiming to provide its subscribers with a continuous stream of quality TV series, seeks funds which would allow it to do so given that it does not generate a sufficient cash flow to support the desired growth in production. The idea is that the company is in the growth stage of its life and it is now when it should start increasing its spending to gain and maintain its market share. Naturally, the fact that the company is still young, and especially because this is the stage when companies either grow into large firms with strong cash flows or they start facing problems and eventually disappear, makes the investment riskier than in larger, established companies.

To reflect this difference in the riskiness of different companies, rating agencies assign a ranking to them. The best ranking, usually referred to as AAA (triple-A), is assigned to the most stable and less risky firms, suggesting that the borrower has an extremely strong capacity to meet its financial commitments. The borrower’s ability to repay declines as the rating declines to AA+, AA, etc., but it is still considered to be of “investment grade” until BBB-. Banks are only allowed to invest in investment grade bonds to avoid extreme risk. Anything below that rating is considered to be “non-investment grade” or otherwise known as “junk bonds”. In essence, below investment grade the borrower is not considered to have adequate capacity to meet its financial commitments.

Back in the 1980s, junk bonds were bonds that were once investment grade at the time of issue, but the rating of the borrower then dropped. Nicknamed “fallen angels” many traders realised that they had regularly been valued less than what they were worth and hence buying them was an an easy way to earn money. As time elapsed speculative bonds which were speculative from the start were also issued, mainly used to finance mergers and acquisitions. However, this has changed since the early 2000s with the majority of the amounts raised going towards corporate purposes (as with Netflix) rather than acquisitions.

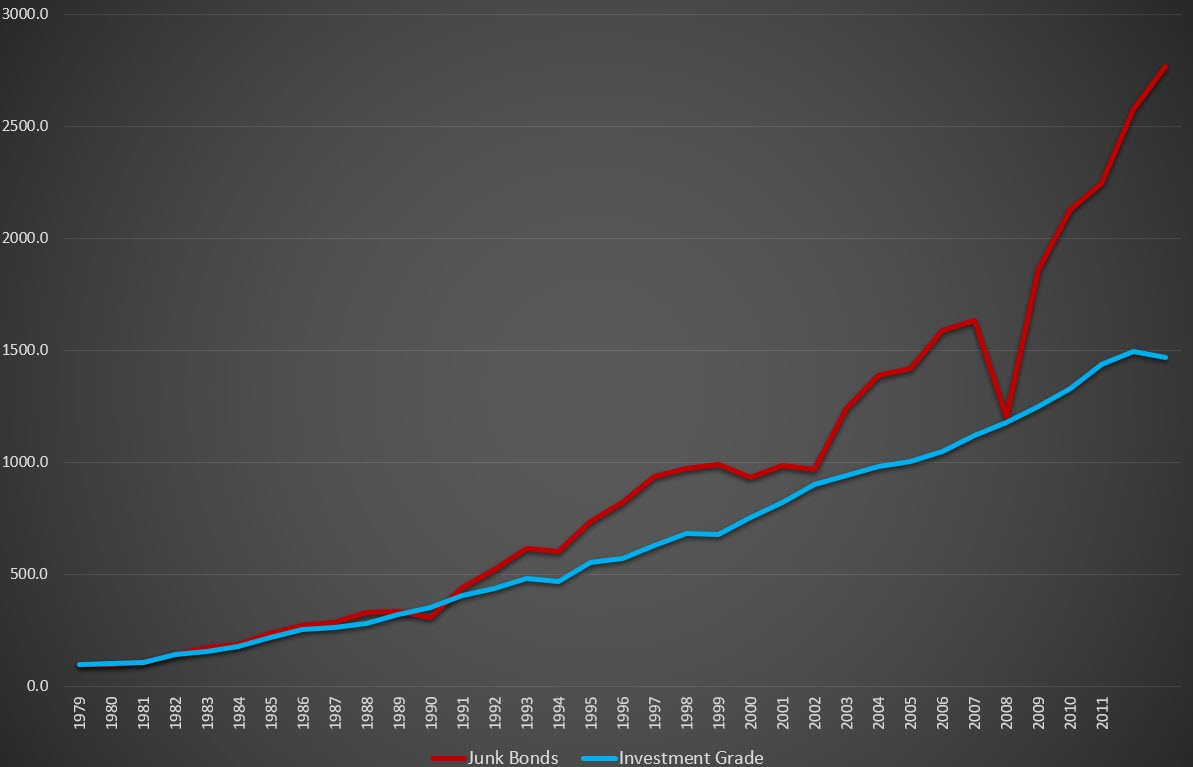

As expected, the higher the rating of a borrower, the lower the interest rate it will have to pay. As such, it can be expected that “junk bonds” would offer the lender a higher return on its investment in order to account for the higher risk associated with the investment. This can be viewed in the chart presented at the top of this post (with data obtained here) where an investment of $100 in junk bonds made in 1979 would eventually be worth approximately $2700 in 2013, despite the large drop in 2008. In contrast, the same investment made in investment grade bonds would be worth approximately $1500 in 2013.

However, just viewing the two returns may be misleading: the fact that the overall market for junk bonds has performed as such does not mean that all bonds have had a similar performance. For example, it likely is the case that some bonds have outperformed the market while others have underperformed. In addition, the default rate of junk bonds has historically been higher than that for investment grade bonds. This simply suggests that it is by far more likely to lose an investment made in junk bonds than in investment grade ones. Returns data, such as the above, usually suffer from survivorship bias meaning that they usually do not include bond issues which have gone bankrupt. As such, junk bonds, with their attractive high yields, offer interesting opportunities to investors aiming at structuring a riskier portfolio.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/24 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.