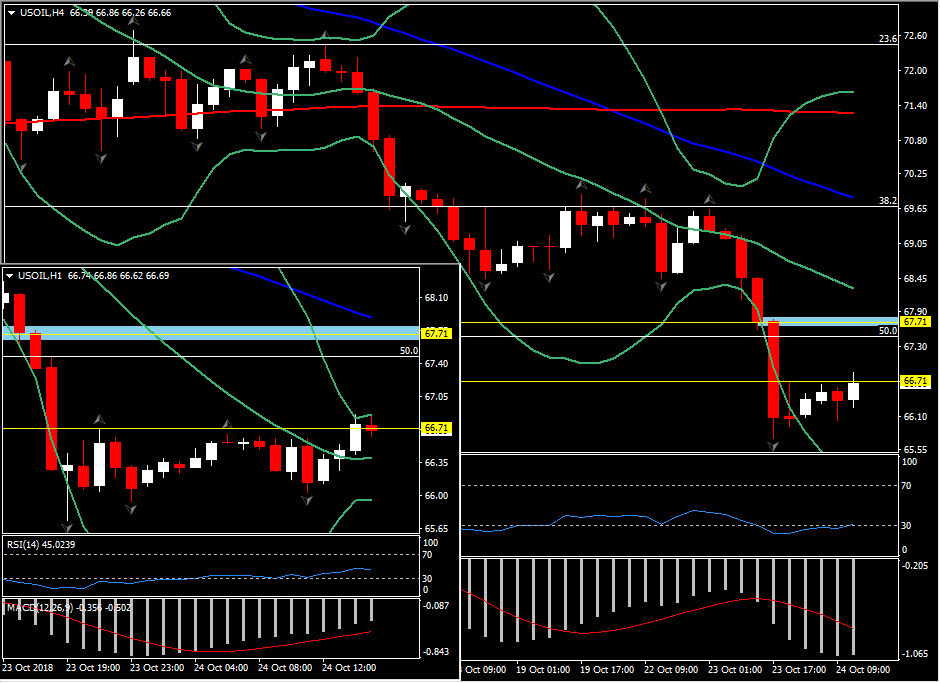

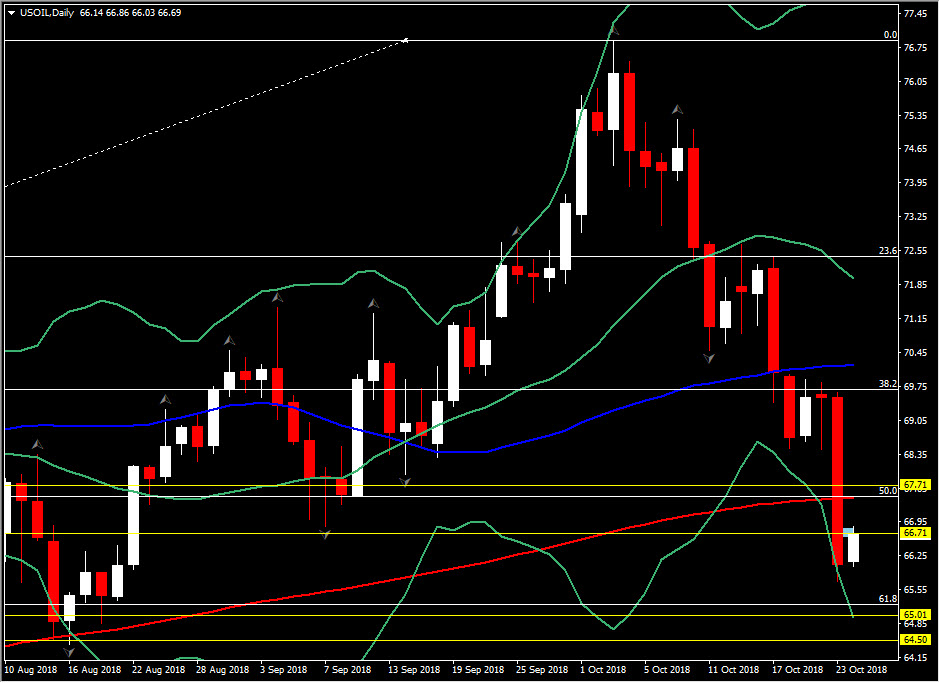

USOil, H1 and Daily

USOil prices are up by 0.1% at $66.70, with oil markets finding a toehold after yesterday’s near 5% rout, which left a 2-month low at $65.75. The low was seen after Saudi Arabia, feeling the wrath of the global community over the Khashoggi case, pledged to keep open its crude supply spigot to head off the impact of US sanctions on Iran. WTI benchmark prices are now showing a 8% month-on-month decline, but are still up by just over 10% on the year-to-date.

In the 4-hour chart, the asset seems to look for a correction of yesterday’s decline, as it rebounded by nearly $1. However this correction to the upside seems to be limited, as the pair remains well below the 20- and 50-period EMAs, while if we zoom in to the 1-hour chart, we could notice that the pair has already hit the upper Bollinger bands pattern, suggesting that might be pulled back towards Bollinger’s mid line. Momentum indicators on the other hand, suggest that the negative momentum holds strongly. RSI is sloping positively but remains closed to the oversold barrier, whilst MACD confirmed a bearish cross with its trigger line. Hence in the short term, only a break above the $67.70 area could imply to a near-term bullish bias. Immediate Support holds at $66.00.

In the medium-term, USoil is likely to continue being traded with lack of upside strength. The negative picture comes initially, as it is traded below 50- and 200-day SMA, with the lower Daily Bollinger Bands extending further to the downside, since last Wednesday. A closing today, below $67.00 could shift the commodity further to the downside, hitting $65.20 or further down to August low at $64.50.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/25 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterised by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.