USOil, Daily

USOil prices slipped down to under $61.20 yesterday, (November 7) as the EIA Inventories showed another weekly build. This week it was over a 5.8 million barrel rise in crude stocks. The market had been expecting a 2.0 million barrel increase, though the API reported a 7.8 million barrel build after the US close on Tuesday (November 6). So far today, the price is up 0.15% at $61.64, consolidating recent sharp losses which yesterday culminated in that $61.20, an eight-month low and the weekly 200-period moving average.

This is now the fifth consecutive week that crude prices have declined. The inventory data this week, together with recent supply increases by Saudi Arabia and Libya and the US vetoes on Iranian export sanctions have collectively been keeping a lid on oil-related markets.

So with sentiment and fundamentals still weighing on the price where do we go from here? The fourth quarter is traditionally a positive one for oil prices, as demand for Heating Oil and its derivatives tends to rise during the northern hemisphere winter months. However, technically, the pressure is to the downside too.

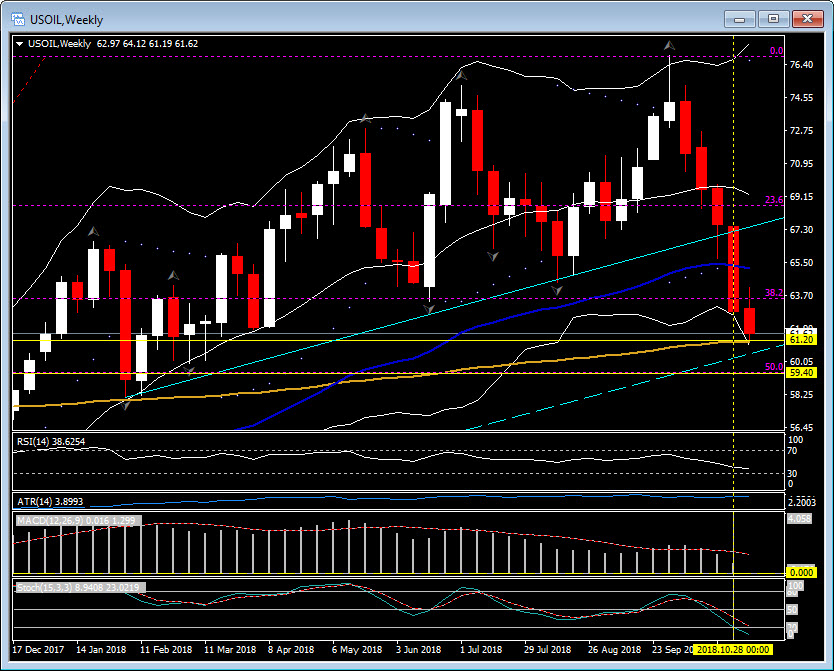

The weekly chart broke below the 2018 supporting trend-line last month (October 28) as it breached, significantly, below the 50-period moving average, before yesterday’s stall at the 200-period moving average. Next support is the monthly trend line at $60.50 and the 50.0 Fibonacci Level at $59.40. The daily time frame has been below the important 20-day moving average since October 11, the 50-day moving average since October 17 and the key 200-day moving average since October 23. RSI and the Stochastic Indicator are both now significantly oversold at 25.2 and 4.5, respectively. However, with the 38.2 Fibonacci at $63.75 and the 200-day moving average at $66.40, a recovery of some 8.5% is required to pull the price back to these levels.

Click here to access the HotForex Economic Calendar.

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.