FX News Today

European Fixed Income Outlook: The 10-year Bund future opened at 159.43, up from a close of 159.37 on Thursday. 10-year cash yields are down -1.3 bp at 0.44%, almost matching the -1.5 bp dip in Treasury yields, which are still holding above the 3.2% mark. Risk aversion picked up again as oil prices plunged and the tech stock rout resumed during the Asian session, while concerns over the Chinese economy flared up again. US stock futures are heading south, led by the NASDAQ futures and FTSE 100 futures are also in the red. The calendar focuses on the first reading of Q3 GDP data and we expect an acceleration in the quarterly growth rate to 0.6% from 0.4% q/q in the second quarter. The UK also releases monthly GDP numbers as well as trade and production data for September. France also has production numbers released at the start of the session, Norway CPI fell back to 3.1% y/y from 3.4% y/y in the previous month. Brexit developments also remain in focus amid signs that the talks are entering the end stage, although the main question is still whether any deal struck by negotiators will be able to get backing in London, as May continues to fight hard core Brexiteers and DUP alike.

Asian Market Wrap: 10-year Treasury yields are down -1.3 bp on the day, but at 3.22%, continue to hold above the 3.2% mark. 10-year JGB yields are unchanged at 0.113%, with bond markets supported as risk aversion flared up again and the stock market sell-off in Asian markets resumed. The Fed remained on course for a December hike, crude entered a bear market on the back of swelling supply and Chinese tech stocks plunged, led by Tencent which reports quarterly results next week. Speculation that the split in Congress may reduce the pressure on the Fed to hike rates were short-lived and the Dollar is on the way higher again. Financial stocks were pressured by news that China aims to boost large banks’ loans to private companies to at least one-third of company lending. Topix and Nikkei have lost -0.51% and -0.98% respectively so far, the Hang Seng underperformed with a -2.44% loss, and Shanghai and Shenzhen Comp are down -1.20% and -0.27%. The ASX was down -0.11% at the close, after RBA reiterated forecasts for higher growth, but also warned of risks from worsening trade war and a weaker Chinese economy. US futures are also heading south and the front end Nymex future is trading at USD 60.64 per barrel.

Charts of the Day

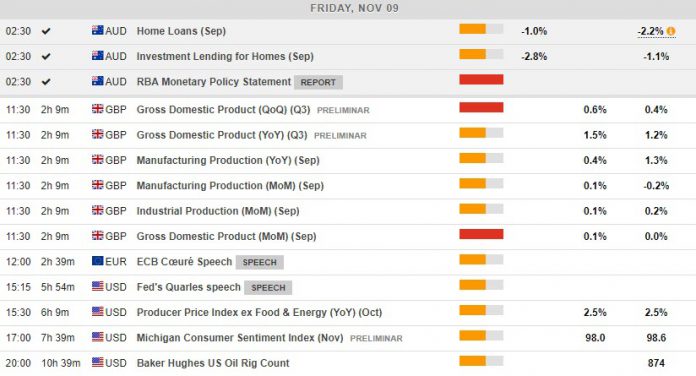

Main Macro Events Today

- UK Gross Domestic Product – Expectations – The UK’s GDP figure is expected to have improved in the third quarter of the year, reaching 1.5% on a y/y basis. Manufacturing and industrial production are both expected to have increased by 0.1% m/m in September, compared to -0.2% last month.

- Consumer Sentiment Index – Expectations – The preliminary reading of the Michigan Sentiment Index is expected to ease off in November, at 98.0 compared to 98.6 in October.

- Producer Price Index – Expectations – The US PPI is expected to have remained at 2.5%, the same as in September.

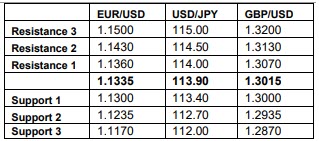

Support and Resistance Levels

Click here to access the HotForex Economic Calendar.

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.