USDindex, Daily and Weekly

US Retail activity and inflation will take center stage in this holiday-shortened week, as they could provide an indication of December’s policy, in which the Fed is expected to continue to raise interest rates. On Friday, a solid gain is widely anticipated in retail sales to start the Quarter. Consumer prices, which will be released today, are expected to post a gain, boosted by energy prices, while import and export prices will likely remain soft.

Today, the Bureau of Labor Statistics is expected to release its Consumer Price Index at 0.2% in October, for the headline and core, with a flat energy reading that should leave a 2.4% y/y headline rise after a 2.3% September gain. The core should slip to 2.1% y/y from 2.2% in September. A moderation in the y/y headline index is expected, to 2.3% in November and December, with a further drop to the 2.0% area in January. The core y/y gauge should remain near 2.2% through December, with risk of a drop to 2.1% in January.

In September, components of the CPI index, such as the Goods and Energy prices, were the ones that drove the index upwards. Today, Goods prices should rise 0.1% for October owing to a 0.7% gain in energy prices related to a 1.5% jump in gasoline prices. Services prices should rise 0.3%. The Goods price index is moving higher from a trough in Q1 of 2016, while Energy prices have risen a net 8.2% in 2018.

Identically, the PPI gains which released last week, suggested that the strength reflected big gains in goods and services. PPI beat estimates with big October gains of 0.6% for the headline and 0.5% for the core that left bounces in the y/y metrics to 2.9% and 2.6% respectively.

Note that last year we saw big post-hurricane gains in energy prices, of 4.7% in September and 3.3% in August thanks to Harvey hitting the Houston area. Hence after last year’s hurricanes, followed by an ensuing moderation, this pattern might appear to a smaller degree this year. This year the dual hurricanes are likely responsible for some upward pressure on October prices, however smaller post-hurricane gains following Florence and Michael are expected, while tariffs might be playing a role as well.

Market risk tends to the upside for October’s inflation, based on October’s PPI, Goods prices performance and Energy prices as mentioned above, and as the weighty shelter component has posted a continuous string of gains since November ’10. Headline inflation has undershot the Fed’s 2% objective in every year since 2011, alongside core price undershoots in every year since 2007. If inflation overshoots today, then this may accelerate the Fed’s tightening path.

Additionally, October’s solid jobs report released 2 weeks ago should keep the Fed on track to raise rates again at the December 18-19 FOMC meeting, following the statement at the November 8 FOMC meeting, in which it left the target range unchanged at 2.00% to 2.25%. Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has declined. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

Accordingly, the stronger the US labor market continues to be, the more the chances that inflation will increase further. Trade war on the other side, with US tariffs mainly being applied on Chinese products, could also be a reason for goods prices moving higher and therefore add to inflation as well.

As the Committee stated that it wants to be consistent with sustained expansion of economic activity, strong labor market conditions etc, a stronger than expected CPI and core CPI reading today would widely increase the expectations of a possible follow-up “gradual” hike in December. Based on this anticipation, a beat on expectations for CPI today, could drive markets to start trading, on the anticipation of a rate hike in December but also for further rate hikes for 2019.

On Thursday, there’s upside risk to October retail sales forecasts of a 0.6% gain for the headline with a 0.5% rise in ex-autos, as consumer confidence measures remain near or at new cycle highs, as is the case with producer sentiment. Various chain store sales measures made gains in October, and look poised to repeat last year’s pattern of a fall acceleration. A positive outcome could be determined by market participants as another factor of further tightening of Fed policy.

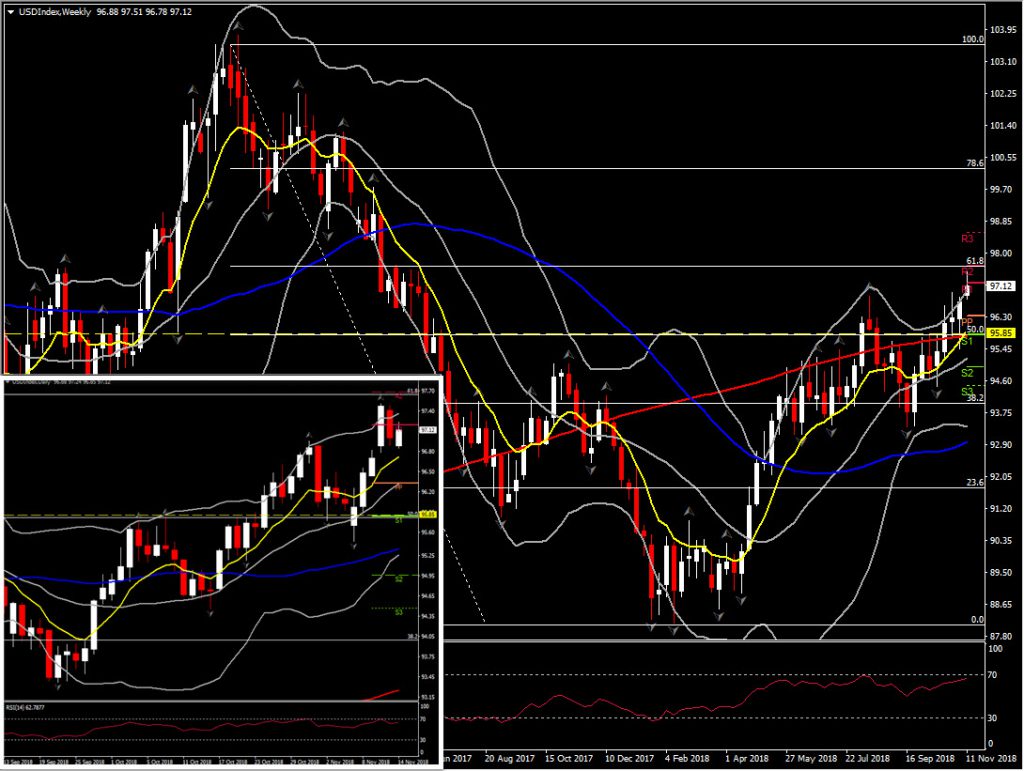

Meanwhile in the currency market, the Dollar has rallied strongly in early-week trading. The latest US data, such as last Friday’s hot PPI numbers, and the Fed’s policy guidance following last week’s FOMC meeting, have fanned expectations for a resumption in Fed tightening at December’s policy meeting, which have underpinned the US currency. The USD index (DXY) posted a 17-month high of 97.51, while currently it is at 97.21, while EURUSD has concurrently printed a 16-month low of 1.1216. The Dollar strength was also a reaction to the political uncertainty that exists in Europe.

Nevertheless, the Dollar has resumed its uptrend as stock markets moved up from lows and sentiment improved as oil prices started to stabilise on reports that OPEC and its allies are considering higher than expected supply cuts. Hence positive data today could boost the USDIndex to 97.51 as seen on Monday but also the confluence of weekly R2 and 61.8% Fib level set since the 2016 fall, at 97.70. If the asset beats this hurdle, it could attract more bulls into the market and hence prompt a retest of 98.50 area.

Oppositely a reversal to the downside could find immediate Support at 95.85-96.00 area (20-day SMA and 200-week SMA).

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.