FX News Today

European Fixed Income Outlook: The December 10-year Bund future opened at 160.14, unchanged from yesterday’s close. The 10-year cash yield is outperforming and down -0.3 bp at 0.393%, while Treasury and JGB rates are slightly higher. Comments from Fed Chairman Powell and ECB speakers yesterday suggest central banks remain on course to take out more stimulus, despite ongoing market volatility and heightened uncertainty. In Europe all eyes will be on the U.K. today after PM May managed to get cabinet backing for the draft Brexit agreement, but today faces a grilling in parliament amid speculation of more resignations or even a no-confidence vote. Developments will overshadow a data calendar that includes UK retail sales and Eurozone trade data as well as ECB speak from de Guindos and Praet.

Asian Market Wrap: 10-year Treasury yields are 0.5 bp at 3.130%, 10-year JGB yields are up 0.3 bp at 0.102% as and Asian markets are mostly posting gains after a choppy session. A stabilisation in oil prices, Brexit developments and comments from Fed Chairman Powell, who seemed to downplay volatility and didn’t give the impression that developments will alter the policy path dominated discussion. Japanese indices, which outperformed yesterday, after underperforming today, but Hang Seng and CSI 300 are up 0.98% and 0.86% respectively amid further speculation of a fresh round of trade talks between the U.S. and China. Better than expected earnings from Tencent Holdings Ltd. also added support. The ASX at least managed to stabilise and post a marginal gain after yesterday’s slide. US futures are broadly higher, after swinging between gains and losses through most of the session. Oil prices are holding above USD 56 per barrel, but are down from highs amid ongoing supply concerns.

Charts of the Day

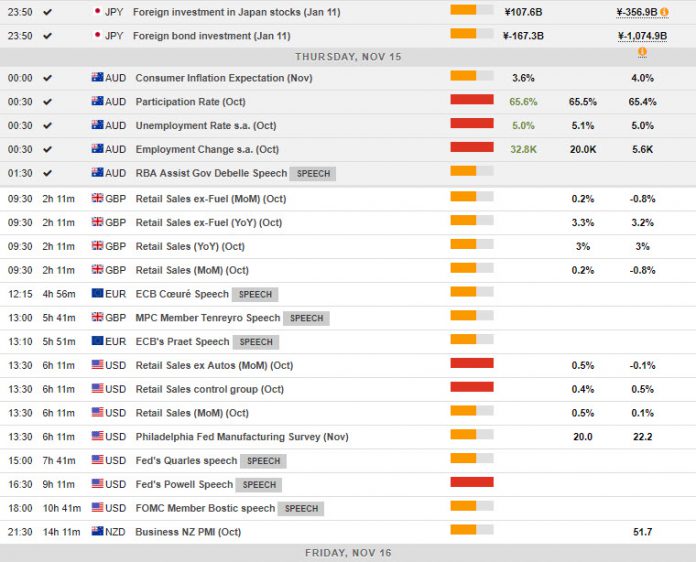

Main Macro Events Today

- UK Retail Sales – Retail sales are expected rising by 0.2% m/m, lacklustre but set to rise strongly in November and December on the back of Black Friday sales, Christmas and winter-related clothing purchases.

- US Retail Sales and Philly index – October retail sales rising 0.6%, with a 0.5% ex-auto gain, for a firm start to Q4, along with a flat reading for October import prices and a -0.1% figure for export prices. A small decline in the Empire State index is forecast from 21.1 to 20.5, while the Philly Fed index is seen falling to 21.0 in November from 22.2 and initial jobless claims are estimated to decline 4k to 210k in the week ended November 10. Business inventories are set to rise 0.3% in September, after a 0.5% gain in August and a 0.7% jump in July.

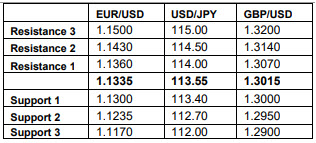

Support and Resistance Levels

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.