FX News Today

FX Action: USDJPY is trading moderately firmer, to three-day highs in the upper 112.0s. Most Yen crosses have also lifted, too, as the Japanese currency came under pressure as Asian stocks managed to claw back some lost ground after a rough start, although most have remained in negative territory. The Nikkei 225 closed 0.4% for the worse, while USA500 futures are up 0.5% after the cash index close out on Wall Street with a hefty 1.8% loss. Sino-US trade tensions remain on the boil, with the Trump administration saying China had “not altered” its alleged predatory trade practices. In data, Japan’s all-industry activity index contracted by 0.9% m/m in September. USDJPY fundamentals (yield differentials and the associated contrast between Fed and BoJ policy paths) remain supportive, though periodic episodes of risk aversion have been an intermittent offsetting bearish force.

Asian Market Wrap: 10-year Treasury yields are up 0.4 bp at 3.066% and JGB rates fell back -0.8 bp to 0.085%. 10-year Treasury yields are still up versus last week’s close, and so far central banks are putting on a brave face and remain on course to take out more stimulus, but global markets are clearly struggling amid the multitude of uncertainties and risks. The sell off on stock markets continues and concerns are spreading to corporate bond markets, with investors struggling to find havens. Japanese indices are broadly lower, although the pace of the decline slowed somewhat during the Asian session, and the -0.35% drop in the Nikkei looks modest compared to the 2.2% slide in the Dow Jones yesterday. Most Asian markets managed to make of some of their early losses during the course of the session and oil prices have come back from an early low of USD 53.39 and are trading at USD 54.14 per barrel. The tech stock sector remains under pressure and the Topix is down 0.60%. The Hang Seng lost -0.58%, while mainland China bourses managed to pare losses and Shanghai and Shenzhen Comp are now up 0.04% and 0.28% respectively as officials hammer out the details of a meeting between President Trump and China’s President Xi Jinping in Buenos Aires on December 1. US stock futures are also moving higher.

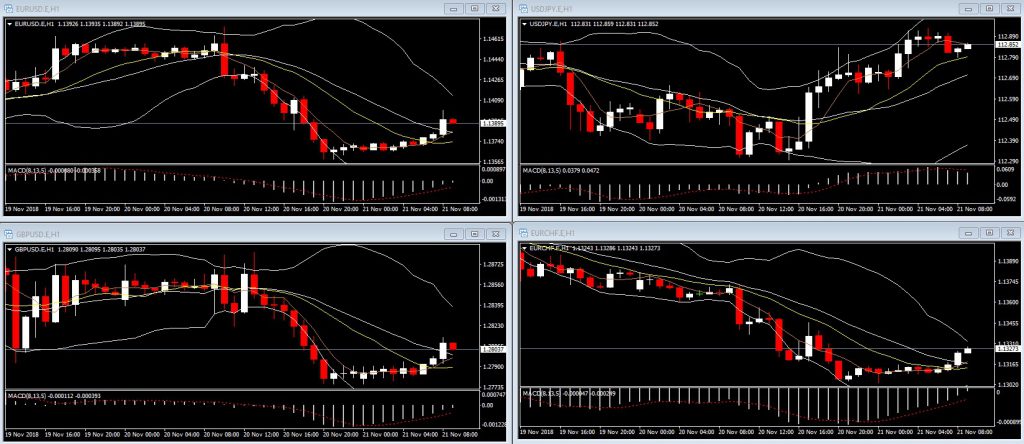

Charts of the Day

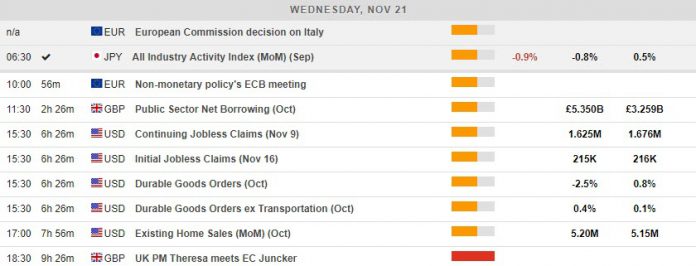

Main Macro Events Today

- Jobless Claims – Continuing Jobless Claims are expected to improve slightly and come out at 1.63 million compared to 1.68 million last week. Initial Jobless Claims are expected to remain roughly the same, at 215K compared to 216K last week.

- Durable Goods orders – Durable Goods ex Transportation are expected to have increased by 0.4% in October, compared to 0.1% last month.

- Existing Home Sales – Home Sales are expected to grow to 5.2 million in October compared to 5.15 million last month.

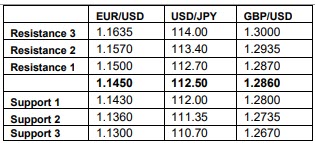

Support and Resistance

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.