FX News Today

Asian Market Wrap: 10-year JGB yields are up 0.2 bp at 0.085%, while most other long rates in Asia declined. The stabilisation in risk appetite continued, during the Asian session as the pressure tech stocks and energy shares eased somewhat. Topix and Nikkei are up 0.81% and 0.65% respectively. The Hang Seng gained 0.12% so far and while mainland China bourses are underperforming they are up from earlier lows and moving higher going into the late part of the session. US bourses are closed for Thanksgiving and trading volumes below average in Asia. The WTI future meanwhile is trading little changed at USD 54.52 per barrel.

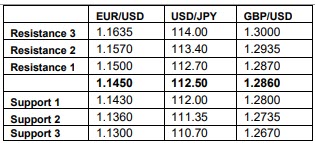

FX Action: USDJPY has traded in a narrow range around 113.00 so far today. Conditions have been thin, with U.S. markets having closed for an extra long weekend, and Japanese markets due to be closed tomorrow. Stock markets have traded mostly higher in Asia. The Nikkei finished 0.7% for the better, while China’s SSE index has recovered intraday losses and is presently near flat in the last hour of trading. Sentiment remains fragile, however, given concerns about U.S.-China trade tensions, though an MNI report yesterday, citing officials, that the Fed is considering a “spring pause” in its tightening cycle has helped lift spirits. In data, Japan’s national October CPI came in at 1.4% y/y, and core CPI at 1.0% y/y, with both matching the respective median forecasts. USDJPY yesterday breached resistance at 113.00-05, which encompasses the prevailing situation of the 50-day moving average, on route to making a four-session peak at 113.22. Support comes in at 112.60-63

Charts of the Day

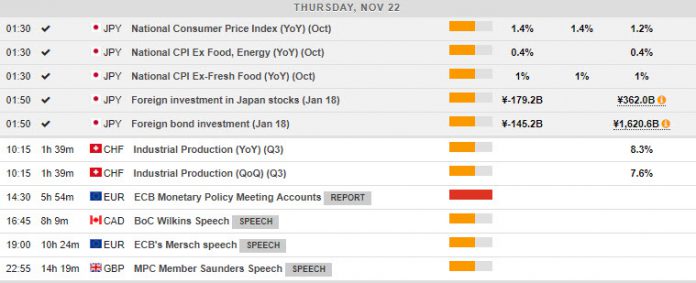

Main Macro Events Today

- United States – Thanksgiving Day – US Markets closed

- ECB Monetary Policy Meeting Accounts – Expectations – The introductory statement was little changed, but Draghi’s presser was a tad more dovish and the minutes are likely to confirm that at least some council members are starting to get increasingly nervous about downside risks and headwinds from market turbulence and slowing world trade.

- Senior Deputy Governor Wilkins speech – Expectations – Gov. Wilkins appears in a panel discussion at the Canadian Mortgage and Housing Corporation’s National Housing Conference, Ottawa.

Support and Resistance

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.