Focus turns to October Canadian Inflation and Retail Sales data:

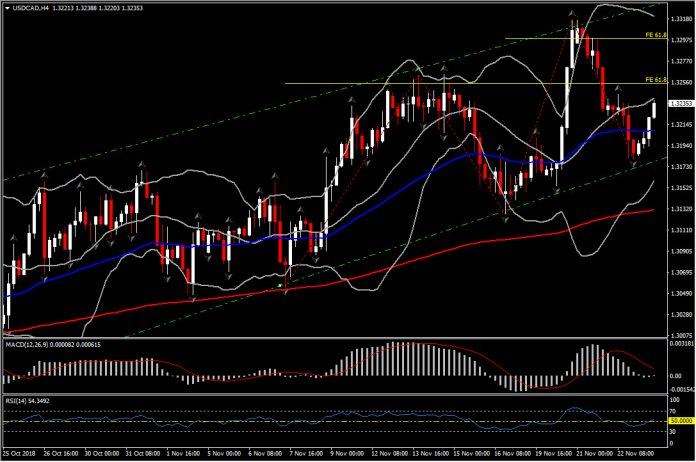

In Canada, there has not been any domestic data so far this week, before the release of CPI, and Retail sales data today. Ahead of the data announcements,USDCAD is currently trading around 1.3230 rebounding from today’s low at 1.3180, after printing a 5-month high at 1.3318 on Tuesday.

The losses seen in Oil for the 2nd consecutive day, weighed on the Canadian Dollar. The WTI benchmark prices are currently showing an 18.8% loss from month-ago levels. The expectations for slower global demand has been a principal driver, correlating with weakening in global stock markets.

The Loonie is currently retesting yesterday’s high at 1.3244, while the next Resistance area is at 1.3250-1.3255, which coincides with the 50% retracement of the 2-day drift and the 61.8 Fibonacci extension since November 16 rebound. A closing today above this area could suggest a retest of November’s peak and the continuation of upchannel identified since October. The Daily Support holds at 20-day SMA, at 1.3170.

As stated, the highlight for the Canadian calendar is the release of Inflation and Retail Sales.

Canadian CPI:

- CPI is expected to grow at 0.1% in October after the 0.4% drop in September. The CPI is projected to grow at a 2.1% y/y pace in October from the 2.2% pace in September. If the core CPI measures remain around 2%, then this implies that it is consistent with an economy operating around potential. This outcome would provide support to the possibility of BOC maintaining a gradual approach to normalizing rates.

- Forecast Risk: Gasoline was about 2.5% lower in October compared to September, which should restrain the index. Car prices rose and mortgage rates continued to climb. But airfares, which were the driver of the pop in CPI during July, remain a wildcard following the change since March in how StatsCan deals with airfares. Finally, declining housing prices could provide some offset to rising mortgage costs. Hence the overall initial take is that the risk around CPI is tilted to the downside due to gasoline prices. However, the special factors and methodology changes applied this year, could upset the forecast. Notably, the underlying CPI growth remains key for BOC’s policy outlook. We expect core CPI rates to hold near 2%.

- Market Risk: BoC took the pop to 3% CPI in stride, citing a jump in airfares, and views the slowing in total CPI since as backing their view that total CPI Core measures will remain “firmly around 2 per cent.” As long as the core measures hold close to 2%, CPI will not be interpreted as hawkish for the BoC policy outlook.

Canadian Retail Sales:

- Retail sales are anticipated to grow 0.1% in September after slipping 0.1% in August. The ex-autos retail sales aggregate is seen expanding 0.3% in September after a 0.4% contraction in August.

- Forecast Risk: Gasoline prices fell 1.1% according to the CPI, which could weigh on total sales.

- Market Risk: While a pick-up in retail sales values would be welcome after the declines evident in wholesale and manufacturing shipments, the broad outlook for Q3 growth is on track to at least match the BoC’s 1.8% projection. The market, notably Oil, has become a driver of policy expectations. Hence, depressed crude prices, are likely to prompt a possible unchanged December rate call from a 25 bp hike.

Click here to access the HotForex Economic calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.