EURCHF, H4, Daily and Weekly

EURCHF dropped sharply to a two-and-a-half month low at 1.1226, breaking Support at 1.1260-61 on route. The losses reflect Brexit-related angst after UK Prime Minister May postponed the parliamentary vote on the EU Withdrawal Agreement, which generated confusion and increased the perceived risk of a hard, no-deal Brexit scenario.

This weighed on both the Pound and the Euro while reviving the Franc’s historic role as a safe haven. SNB conducts its next quarterly policy review this week (Thursday). The central bank has been continuing to tread carefully amid heightened uncertainty about the economic outlook, geopolitical risks and protectionist threats.

Recent market volatility and Brexit risks will do little to change SNB’s stance, and hence it is widely expected that the central message will be that the situation remains fragile and the currency “highly valued” while maintaining policy unchanged.

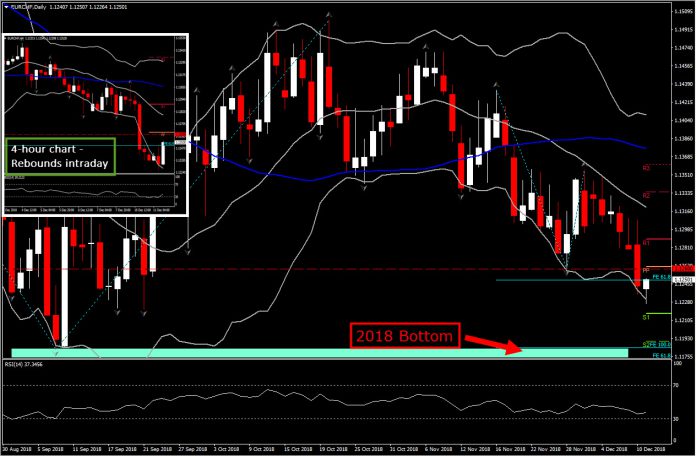

In forex market meanwhile, the EURCHF confirmed our September 12 observation:

“Meanwhile, by observing the performance of the pair since May, we have also noticed that it seems to be forming the Elliot Wave theory, as it is presenting so far a 5-waves move in the downtrend. Theoretically, such move is followed by 3 corrective waves (a 5-3 move). Technically-wise, all the above, along with a closing above the 1.1330 Resistance level, could signal the possibility of 3 corrective moves to the upside. “

“Daily/Weekly: A close above the 20-day SMA and the 2-week peak, at 1.1330 – 1.1343, may meet resistance around the 1.1465-1.1470 Resistance area, this being the latest up fractal in the daily chart and the confluence of 50-day SMA and upper Bollinger Bands pattern. In case of further upside extensions, the price could re-challenge the 1.1635 level, taken from 200-day SMA.”

The market indeed confirmed, in November, the retest of 1.1465-1.1470 Resistance area as stated above, with the pair moving up to 1.1500 high and rejecting this level and returning lower today at the 1.12 territory.

Hence as the next immediate Support area, at 1.1170-1.1180, represents the bottom of 2018, but also the 61.8% Fib. level set on 2017 rally, the FE100.0 and the FE 61.8 set in medium term and short term respectively.

Breaking this area, could imply a “free fall” for EURCHF, with the next Support set at FE161.8 and the 200-weekly SMA, at 1.1060-1.1080.

Medium-term indicators are configured negatively, with further steam to the downside. Intraday, the pair gains some traction, as the German ZEW investor confidence unexpectedly improved in expectation reading. Nevertheless, the negative bias holds, as the pair is trading further below the 1.1300 barrier.

Click here to access the HotForex Economic calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.