FX News Today

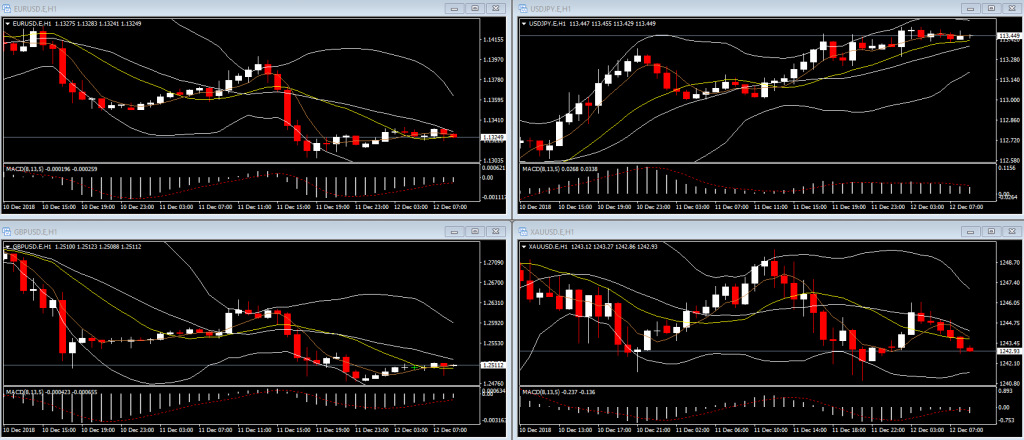

- USDJPY has posted a nine-day high of 113.51, in what is a second consecutive day of gains. AUDJPY has concurrently printed a six-day high, while EURJPY and other Yen crosses have seen intraday strength. A revival in risk appetite in global markets has seen the some of the Yen’s safe haven premium unwind.

- 10-year Treasury yields are up 1.1 bp at 2.89% while 10-year JGB yields gained 0.8 bp and are at 0.045%, as stock markets rallied across Asia.

- Topix and Nikkei rallied 1.99% and 2.15% respectively, the Hang Seng gained 1.72%, Shanghai and Shenzhen Comp managed gains of 0.41% and 0.35% respectively and the ASX rose 1.39%.

- Markets in India, hit by the shock resignation of the central bank president yesterday, recovered after an ally of PM Narenda Modi took over.

- US stock futures are also broadly higher, led by a 0.9% rise in the NASDAQ futures and European stock futures are also moving up. Oil prices are trading at USD 52.32.

- News that Canada granted bail to Huawei’s CFO, arrested for extradition to the US, helped to ease tension outside of China.

- Trump sparked a risk-on turn after saying in an interview with Reuters that talks were ensuing with Beijing by phone, and that he would not raise tariffs on Chinese imports until he was sure about a deal.

- He also said that he could intervene in the case of the detained Huawei CFO if it would benefit US national security or help secure a trade deal with China and was ready to meet with President Xi Jinping. After signals that China may cut tariffs on auto imports, more positive signs are recorded on global trade tensions.

- Trump also added that it would be “foolish” for the Fed to hike rates at its policy meeting next week.

Charts of the Day

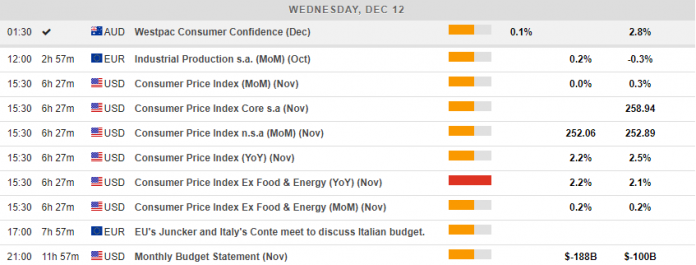

Main Macro Events Today

- Euro Area Industrial Production – Industrial Production in the Euro Area is expected to have increased by 0.2% m/m in October compared to -0.3% in September.

- US Inflation Rate – The US CPI inflation rate is expected to have stood at 2.2% y/y in November (both Core and Overall Indices), despite signs of a mild deceleration in growth, as per the NFP numbers.

- Teresa May scheduled to go to Ireland, possibility of no confidence vote as early as today.

- Junker and Italy’s Conte are to meet about the Italian budget.

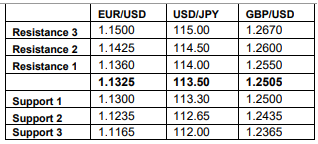

Support and Resistance Levels

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.