US equities snapped higher after copycat declines in Asia after yesterday’s deep rout following “bear market” references by Gundlach. Sputtering global growth, external pressure on the Fed to halt rate hikes and ongoing trade/tariff concerns have continued to plague investors into year end.

China’s Xi did not include any olive branches in his keynote speech. However unlikely, it is possible the Fed could relent with a pause into year-end and spark a Santa rally on stocks, but kowtowing to Trump and other critics could be a bitter pill.

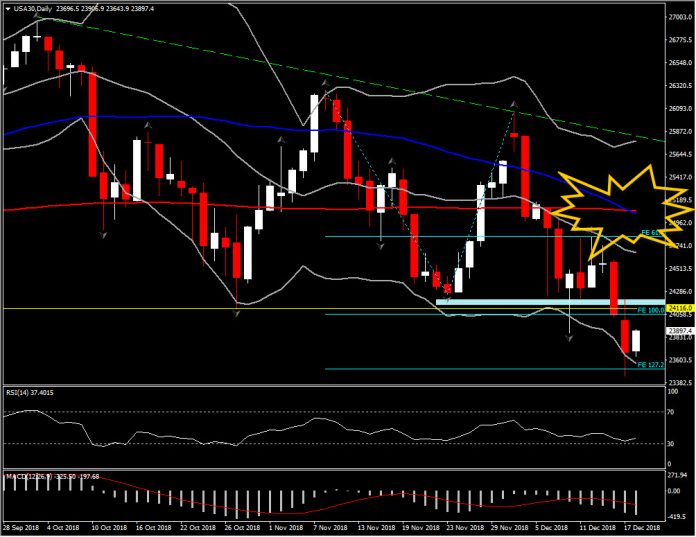

“Death crosses” of 50- and 200-day Moving Averages have been popping on the major US averages, with the USA30, buying a little more space at least in pre-open trade before breaching its 200-day MA of 25,081 vs 50-day MA of 25,103 as of yesterday’s close. The USA30 is 134-points higher, USA500 gained 14-points and USA100 is up 36-points after 2.0-2.2% declines Monday.

Despite the gain noticed so far today, the break of 2-month floor at 24,116, along with the formation of a Death Cross keeps the index remains in a bearish outlook. Currently, the asset is traded at 23,908, with immediate Resistance at FE100 from November’s reversal, at 24,050. Support is set to the confluence of lower Bollinger Bands and FE 127.2, at 23,510. Further losses could lead towards February’s lows at 23,200 .

Click here to access the HotForex Economic calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.