FX News Today

- The Aussie Dollar strengthened on expectations of progress in trade talks between China and the US. President Trump said that he had a “long and very good call” with his Chinese counterpart Xi Jinping and a possible trade deal between the United States and China was progressing well.

- Still, market sentiment remains fragile over looming concerns of slowing global growth and a partial US government shutdown.

- Bourses remained closed in Japan and mainland China, while markets in Australia closed early.

- The Hang Seng rallied 1.34%, compared to a -0.14% loss in the ASX and US futures are moving higher as traders put their hope in US-Sino trade talks.

- The broad MSCI ex-Japan index managed a 0.6% gain, and US futures are also moving higher, suggesting a somewhat more mellow mood in markets on the last trading day of the year.

- The broad MSCI ex-Japan till lost 16% this year, while the Nikkei shed 12% in 2018 and the CSI 300 lost around a quarter of its value, highlighting that investors are taking a very gloomy view on the outlook for the world economy.

- Oil prices are moving higher and the front end WTI future is trading at USD 45.90 per barrel.

Charts of the Day

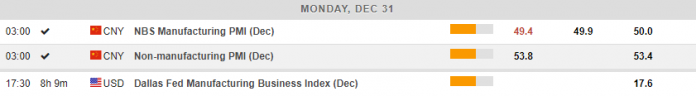

Main Macro Events Today

- A holiday across the majority of markets (including Japan, Germany, Italy, China, and Brazil), while the UK, New Zealand, Australia, France and Hong Kong markets will close early.

- Dallas Fed Manufacturing – This monthly survey aims to obtain a timely assessment of the state of Texas factory activity. The indicator is expected to stand at 17.6, the same as last month, still indicating growth given that it is higher than 0.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.