FX News Today

- Markets didn’t have a good start to 2019 as disappointing data out of China rekindled concerns about the health of the Chinese economy.

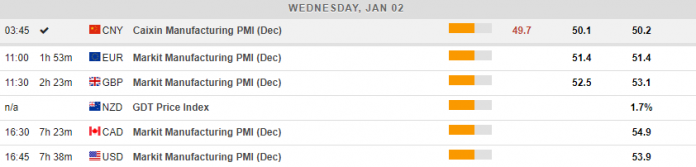

- China’s Caixin manufacturing PMI fell into contraction territory at 49.7, which together with the fact that both private and official PMIs suggest a correction in orders inflow saw investors heading for cover.

- Japan remained closed but Hang Seng and CSI 300 declined -2.68% and -1.38% respectively, while the ASX lost -1.57%.

- Chinese 10-year yields dropped -12.1 bp and stock futures in the US and Europe are also heading south, indicating wide spread losses for stock markets on the first trading day of the year.

- The broad market movement suggests a drop of the Dollar, as a cautious mood prevailed on the first trading day of the year on concerns over global growth, the US government shutdown and a slower pace of Federal Reserve rate hikes.

- In addition, the worse than expected Dallas Fed index, which plunged to a 30-month low in the last day of the month also had its bearing on the Dollar.

- Oil prices also fell back and the front end WTI future is trading at USD 44.82 per barrel.

Charts of the Day

Main Macro Events Today

- EU Markit Manufacturing PMI – The European manufacturing index is expected to have remained flat at 51.4 in December. Among the countries, the Italian and Spanish indices are expected to have decreased slightly, while it is expected to have remained similar for the rest of the large countries.

- UK Markit Manufacturing PMI – In the UK, manufacturing is expected to have deteriorated in December and stand at 52.5, compared to 53.1 in November.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.