USDCHF, H4 and Daily

The Dollar is trading mostly weaker, with EURUSD punching out a two-month high within a whisker of 1.1500 while USDJPY dove to a seven-month low of 109.12.

Most of the USDJPY price action dynamic and USDCHF price action, have been a reflection of general Yen and Swiss franc strength driven by safe haven demand as stock markets across Asia and US equity futures made a negative start to 2019 trading.

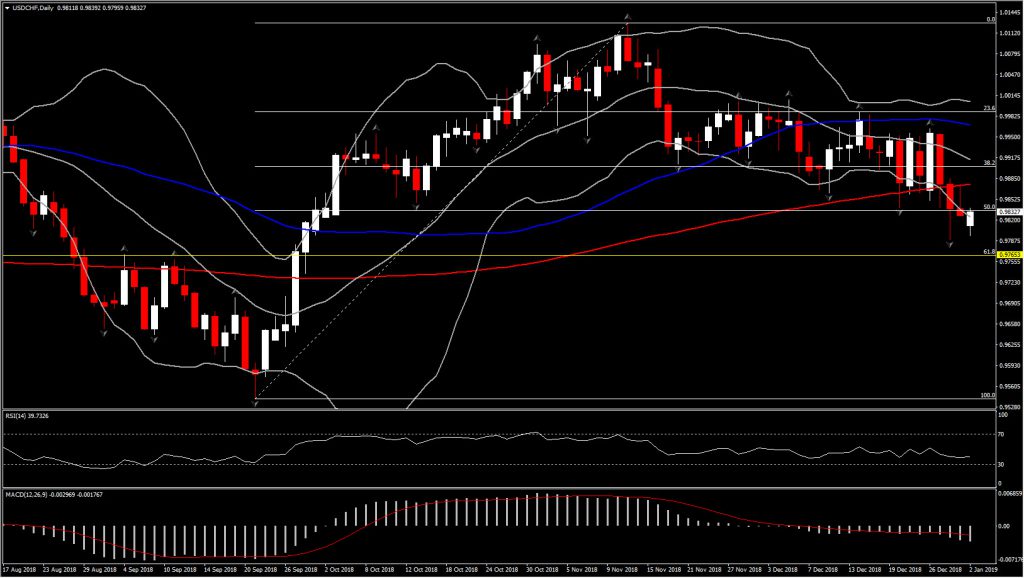

Both assets ended 2018 negatively, as presented by the 3-week decline in December and the trading below the 200-day SMA but also the 50% Fibonacci retracement from the 8-month bottom at 0.9525.

As the asset is trading below 50% Fib. level, and the momentum remains negative, it is clear enough that the next Support is set at the 61.8% Fibonacci retracement level of the upleg from 0.9525 to 1.0128, at 0.9765. A breach of this Support could accelerate the declines towards the August low at 0.9650. Immediate Resistance comes at 200-day SMA and Monday’s peak at 0.9876.

Intraday, USDCHF rebounded from day’s low. The flat Eurozone December Manufacturing PMI, might be the reason for the intraday weak Swissy, as today’s data once again provided clear signs of decelerating growth momentum, which fits into the market narrative of slowing growth globally and is adding support to core bond markets.

However, the pair would need to aim even higher, above 0.9900-0.9950, in order to eliminate the bearish bias. Hence the series of lower highs could only suggest a correction to the upside and therefore a chance for further declines.

Click here to access the HotForex Economic calendar.

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.