FX News Today

- Fed officials continue to pledge patience after Fed Chair Powell noted the balance sheet will be “substantially smaller”.

- ECB minutes confirmed decision to end QE was unanimous.

- On the growth risks, there seems to have been a debate on the impact of weaker confidence indicators, with some mixed views.

- The Central banks are increasingly wary of downside risks and their cautious messages support both stock and bond markets.

- US equities stumbled after trade talks ended with few details for all the prior rejoicing, while a handful of year-end stumbles in the retail sector were noteworthy.

- European stock futures are moving higher, after a largely positive session in Asia overnight.

- US futures are also clawing back overnight losses with cautious comments from Fed and ECB officials supporting both bond and stock markets.

- WTI crude is holding gains and trading at USD 52.56 per barrel.

Charts of the Day

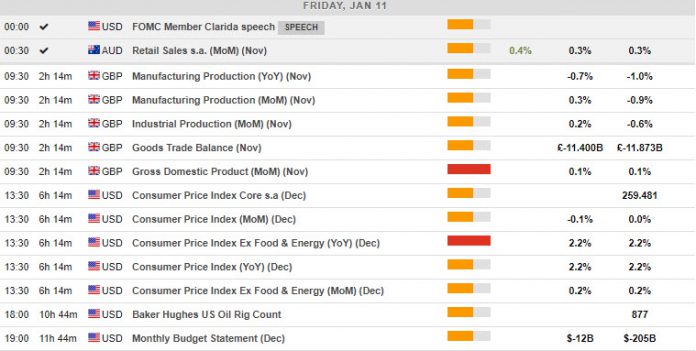

Main Macro Events Today

- UK Manufacturing & Industrial Production – Expectations –Industrial output is expected to have recouped 0.2% m/m after dropping 0.6% m/m in October, while the y/y figure should come in at -0.7%. Manufacturing production should rise to 0.3% m/m, after the fall to 0.9% last month due mainly to weakness from transport equipment.

- US CPI and Core – Expectations – It is widely anticipated that we will see an energy-depressed -0.1% reading for headline CPI in December, but a warmer 0.2% gain for core prices.

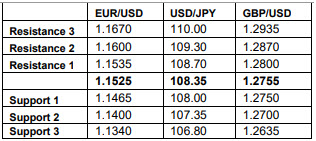

Support and Resistance Levels

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.