FX News Today

- Treasury yields jumped and global stock markets rallied on fresh hopes of progress in US-Sino trade talks.

- WSJ reported that the US is weighing lifting tariffs to hasten a trade deal and calm markets.

- Topix and Nikkei are up 0.93% and 1.29% respectively. GER30 and UK100 futures also moved higher in tandem with US futures.

- US Equities also surged on Morgan Stanley earnings miss.

- USDJPY popped to better than 2-week highs of 109.40. USDCAD fell sharply to 1.3246 from over 1.3300.

- Swiss Franc down vs most currencies, following dovish remarks by SNB’s Jordan – “too early for a change” as he mentioned.

- Global trade developments and, in Europe, Brexit developments, remain in focus.

Charts of the Day

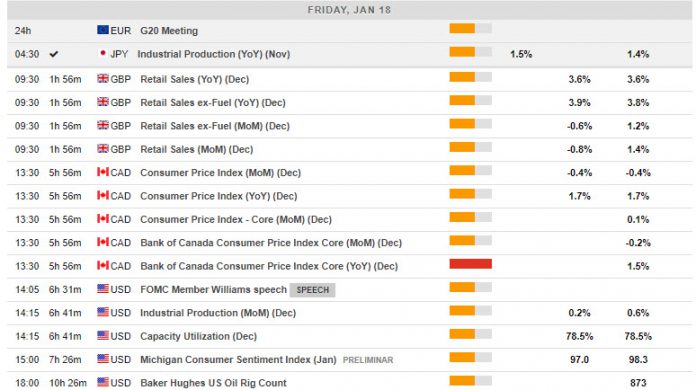

Main Macro Events Today

- UK Retail Sales – Expectations – December retail sales are expected to decline by 0.7% (median -0.5%) after rising 1.4% in November.

- US Industrial Production & Prelim UoM – Expectations – Industrial Production is seen rising another 0.3% in December after a solid 0.6% gain in November. Preliminary January Michigan sentiment should decline to 96.0 after the surprise increase to 98.3 in December.

- Canadian CPI and core – Expectations – A 0.3% m/m drop in CPI during December is anticipated, after the 0.4% plunge in November, with weaker gasoline prices again projected to fuel the decline. The core CPI measures all ran at 1.9% y/y in November, while inflation should either hold at those rates or tick lower.

- Fedspeak: NY Fed’s Williams (permanent voter) gives his views on policy and the economy. Philly Fed’s Harker (nonvoter) speaks at a symposium on prosperity.

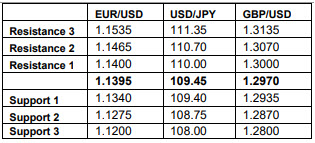

Support and Resistance Levels

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.