USDCAD

Today, Canada releases its December inflation figures. The three core CPI measures are expected to hold around the 1.9% rates that were seen in November, while underlying inflation expected to either hold at those rates or tick lower.

In terms of potential policy implications, Q4 and Q1 GDP are expected to be weak and CPI similarly soft, thanks to the drop in oil prices. Hence the weaker gasoline prices are again projected to fuel the decline of the headline CPI today.

The Bank views the Q4/Q1 softness as temporary, with growth and inflation perking up in the second half of this year. Therefore, soft data for Q4/Q1 will be consistent with the now widely expected delay in more rates hikes until the end of the second half of this year, when BoC will have Q1 GDP data in hand and can judge if the time is right to resume rate increases.

This implies that another sub 2% reading on total CPI, along with core CPI today, should not challenge BoC’s outlook, and hence will likely be taken in stride by the market.

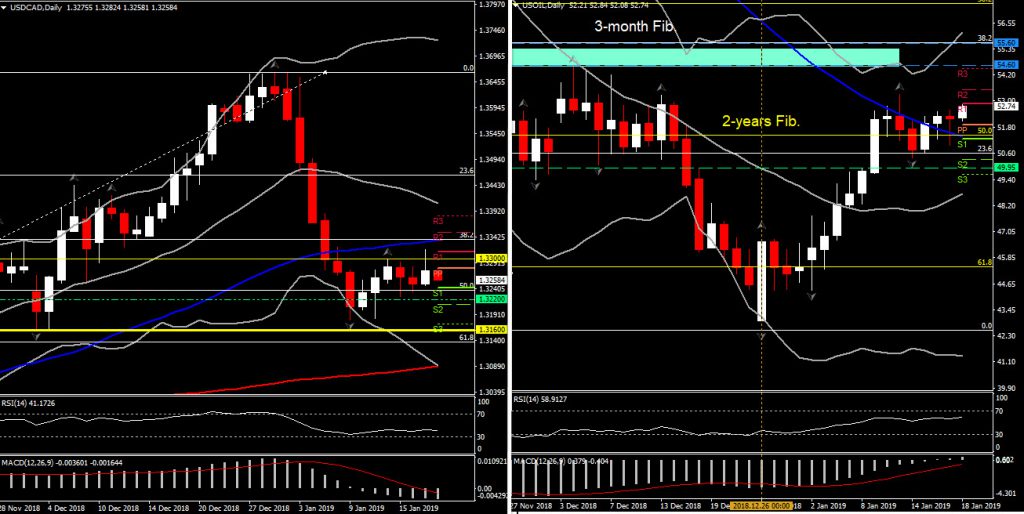

From a market perspective, a positive outcome today, could boost further 2019 gains for USDCAD. Loonie has reverted more than 23.6% of 2018’s losses so far and is currently trading at the mid of the 1.3200s. The Canadian Dollar and its Dollar bloc brethren found support on news that China is implementing tax cuts and other measures to stimulate its economy. Since then there have been signs that the Trump administration is more eager to strike a deal with China on trade, which has returned support to the Canadian Dollar.

USDCAD has Support at 1.3220 (50% Retracement for Q4 2018) and immediate Support for the day at S1, at 1.3240. Further down movement could trigger our attention to 2 month Support at 1.3160, but could also open the doors to 200-day SMA at 1.3090.

Oppositely, a miss on data’s expectations could lift USDCAD above 7-day barrier at 1.3300. A close today above this barrier could imply retesting the 20-day SMA at the round 1.3400 level.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.