USD holds at highs (USDIndex 104.51), Stocks closed up over 2% (NASDAQ +2.51%) – (1) dead cat bounce & another bear market rally or (2) signs of peak inflation and peak Fed bearishness ? (Technicals & Fundamentals still say 1). Asian shares closed lower on rapid spread of new Omicron (Hang Seng -1.49%) Yields rheld their gains. Oil also slumped (Brent -3.42%) Gold & BTC slide sideways. Biden expected to announce temp. tax reprieve on gasoline, BOJ Mins confirmed they will ease further if necessary “without hesitation” USDJPY hits new 24-year high. NZD hit by weak trade data.

- USDIndex tested 103.72 on Tuesday before rallying to 104.55 now.

- Equities – USA500 closed +2.45% (3764), US500FUTS slumped to 3719 now.

- Yields 10-year yield higher, closed at 3.26% , trades at 3.29% now.

- Oil & Gold had mixed sessions – USOil slumped 3% to trade at $104.90. Biden & Omicron news weighed & Gold could not hold $1830 and trades at $1825 now on higher Yields and stronger USD.

- Bitcoin continues to pivot around $20K, test $22K yesterday, back to $20K now.

- FX markets – EURUSD hback under 1.0500, USDJPY hit new 24-yr highs at 136.71 and Cable trades down to 1.2225 now, following Inflation news, from 1.2325 highs yesterday.

Overnight – UK CPI hits 9.1% inline but up from 9.0% last month, CORE a tick lighter at 5.9% vs 6.0% & 6.2%, PPI beat 2.1% vs 1.8% & 2.7% prior and RPI also hotter at 11.7% vs 11.4% & 11.1% last time. NZ Trade Balance less than 50% of forecast at . Reuters Poll Fed Path: 75bp July, 50bp Sept & Oct, and 25bp Nov. (at the earliest). Japanese official – FX moves against the Yen “not ideal”

Today – Canadian CPI, EZ Consumer Confidence, Speeches from Fed’s Powell, Barkin, Evans & Harker, SNB’s Jordan ECB’s de Guindos & Elderson, BoC’s Rogers.

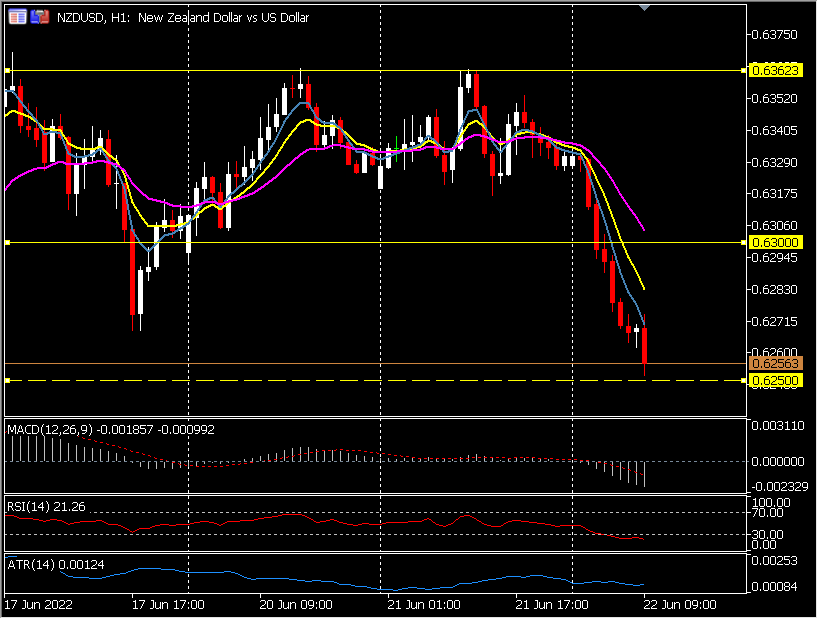

Biggest FX Mover @ (06:30 GMT) NZDUSD (-1.18%). Collapsed from test of 0.6360 on Monday & Tuesday to 0.6250, as NZD Trade Balance missed significantly. MAs aligning lower, MACD histogram negative turning lower, RSI 21.25, OS but still falling, H1 ATR 0.00124, Daily ATR 0.00850.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

#USDJPY – Summer 1998 went to 147.00, Spring 1990 went to 160.00. New 24 yr high today at 136.71