XAGUSD

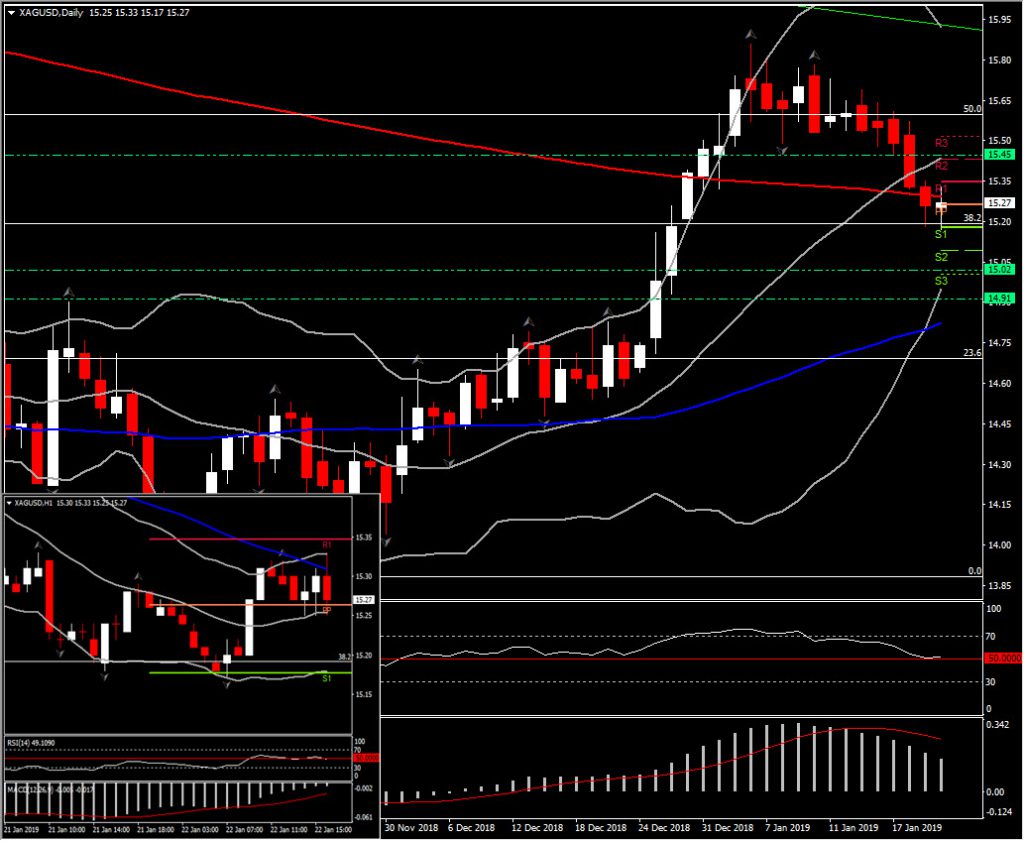

By completing its worst year since 2015 due to the strong US Dollar, Silver sparkled in the last week of December, reversing nearly 61.8% of the losses seen since June, up to $15.86. However, in January, this level proved once again to be a reversal point, as the asset pulled back from December’s high and is currently trading a breath above the 38.2% Fibonacci retracement level.

With 3 consecutive weekly lows along with the break of 20- and 200-day SMA, there is only a short-term Support at 32.8% Fib level at 15.20, which it has already hit twice this week, therefore it cannot provide a strong barrier against downwards movement. Therefore the next real Support stands at 14.90-15.00 area (Round level and September to October Resistance). A decisive break below the 14.90 barrier could lead the asset to 2018 lows, with an initial Support at 14.20.

Despite today’s slight improvement, the momentum indicators signal that the market could maintain negative momentum intraday and in the medium term as well. Daily RSI stalls at 50 from 78 high, while intraday remains below neutral zone. MACD lines are accelerating lower, suggest a rising negative bias sentiment.

Technicals keep Silver in a negative outlook, hence today’s rebound could be a sell opportunity before the asset continues southwards again. Intraday Resistance holds at 15.35. Next Resistance is set at 15.45 which coincides with 20-day SMA but also R2 from day’s Pivot Point Analysis.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.