FX News Today

- 10-year Treasury yields are down from overnight highs, but still up 0.7 bp at 2.746%, and 10-year JGB yields climbed 0.8 bp to -0.004%.

- Stock markets remained cautious during the Asian session.

- The Bank of Japan held policy steady, as expected, while further reducing its outlook for inflation. The resulting weakness in the Yen didn’t help stock markets and Topix and Nikkei dropped -0.60% and -0.14% respectively.

- The Hang Seng is also down -0.04%, despite mainland China markets initially moving higher as China’s central bank pumped liquidity into the banking system once again. Still, the measures are also a sign that officials are nervous about the slowdown in the economy and CSI 300 and Shanghai Comp are down -0.24% and -0.13%. The bank offered around 258 bln Yuan (USD 38 bln) to banks through its medium term lending tool.

- Markets continue to question the progress in the US-Sino trade talks, even though White House adviser Lawrence Kudlow said that the trade talks are still on and the story about cancelled preparatory meetings was “not true, there was never any meeting. We are moving toward negotiations.” The negotiations next week will be “very, very important” and “determinative”.

- Meanwhile, there are the first signs of a possible way out of the US government shutdown.

- Markets remain easily spooked, but appear to have already priced in a lot of risk last year and US stock futures are moving higher after yesterday’s sell off. Oil prices are trading at USD 53.27 per barrel.

Charts of the Day

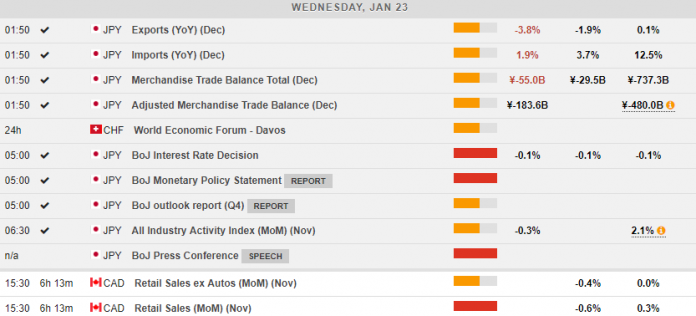

Main Macro Events Today

- Canadian Retail Sales – After Wholesale Sales plummeted yesterday, Canadian Retail Sales are expected to have also declined by 0.4% m/m, with core Retail Sales (ex autos) expected to have declined by 0.6%.

- World Economic Forum at Davos –The second day of the WEF annual meetings held in Davos and attended by officials from over 90 countries. Comments from central bankers and other influential officials can create significant market volatility.

- Richmond Manufacturing Index – Expectations – The index is expected to have remained at a sub-zero level, standing at -2 after the -8 in the December release.

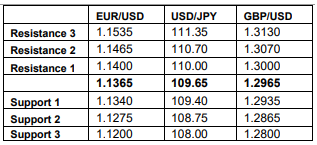

Support and Resistance Levels

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.