The Swiss Franc has been one of the strongest currencies this month with only the USD doing better, albeit by a small margin, supported by strong risk-off flows which has seen Equities and Commodity prices fall strongly so far in June – US500.F fell about 11% before paring some of its losses this week while USOil is down about 3.7% in June.

The Swiss National Bank was hawkish in in their meeting last week, where they raised interest rates for the first time in 15 years by 50 basis points to -0.25% to counter inflationary pressures, which printed 2.9% in May. This move shows the SNB has learnt a lesson from the inflation situation in other major economies and are willing to act to curb inflation before it runs rampant.

Markets have since priced in a nearly 100% expectation for a 50 bps hike and are currently expecting a 66% chance of a 75 bps hike as the SNB implied that further rate increases should be expected. The ECB on the other hand have a lot on their plate, with fragmentation risk among European countries as highly indebted nations like Greece, Italy, Portugal and Spain may struggle with higher interest rates more than others and this may see more inflow into the Franc through the EURCHF rates, especially after the SNB implied they were more accepting of a stronger Franc.

The Swiss economy has remained resilient despite headwinds from the tension between Russia and Ukraine which has strongly increased the cost of energy. Switzerland imports over 70% of its energy consumption and the COVID situation in China dampened demand from Switzerland’s 3rd largest trade partner after the EU and United States. Q1 GDP grew to 0.5% above market expectations, the non-seasonally adjusted unemployment rate in May was 2.1%, down from 2.3% in April and the inflation rate grew to 0.7% in May, taking the annual rate to 2.9%.

Over the coming weeks, we could see further strength in the Swiss Franc, considering the hawkish pivot from the SNB and expectations to hike rates further, the bank’s willingness to accept a stronger Franc – although the bank also noted that they are willing to be active in the Forex market which means intervention if the CHF gathers too much strength – and the expectation for global economic slowdown amid central bank tightening, which supports the currency as a safe haven.

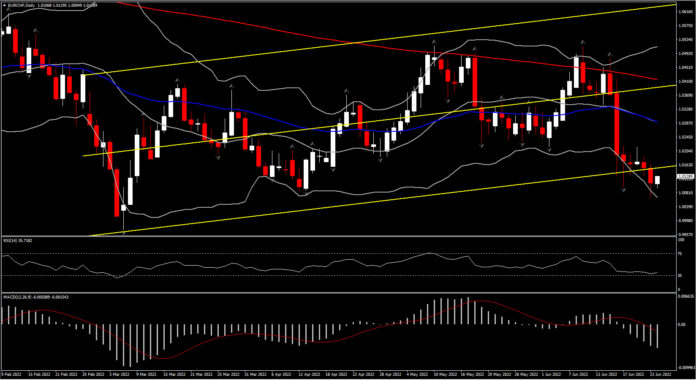

#EURCHF is down about 1.8% so far this month after initially climbing 2.3% as risk off sentiment and SNB action spurred the downside. After a tight range from late last week, the pair has finally made its way to the 1.01 support level again which held as previous cycle low going back to mid-April. #EURCHF currently trades below all three daily MAs, after breaking the year’s ascending channel last week. The retest of the 1.01 level could attract more bears that may take the price to 0.997 which is the lowest point on the pair since January 2015 when the Swiss National Bank announced the end of the EURCHF peg. Alternatively, an improvement in risk sentiment, jawboning by the SNB or effective action by the ECB to counter fragmentation risk could see the pair pare some of the losses recorded this month as it currently trades in the oversold region heading into the end of the first half of the year.

Click here to access our Economic Calendar

Heritage Adisa

Market Analyst – Educational Office – Nigeria

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.