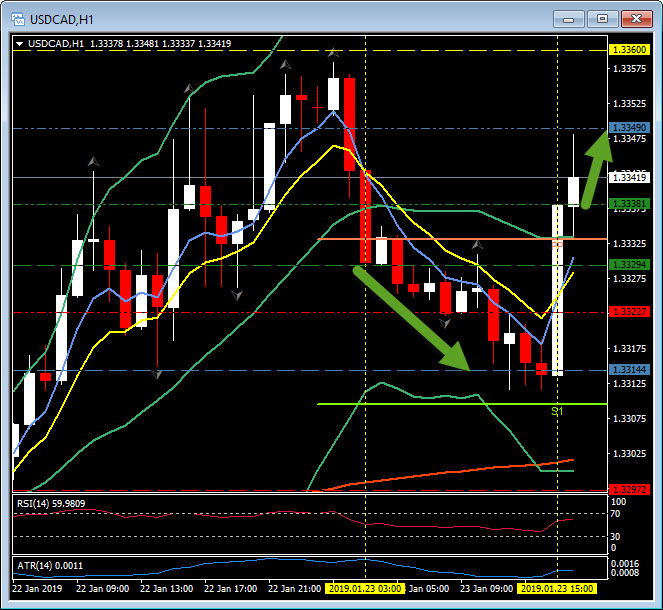

USDCAD, H1

Canada retail sales fell 0.9% in November after the 0.2% gain in October (revised from +0.3%). The ex-autos sales aggregate contracted 0.6% in November after a 0.2% decline in October (revised from 0.0%). The total and ex-autos sales declines outpaced expectations, and were driven by a 5.0% drop in gasoline station sales (due to lower prices) and a 1.8% loss for motor vehicle and parts dealers. Retail sales volumes fell 0.4% in November, joining the 0.9% decline in manufacturing sales volumes and a 1.2% fall in wholesale shipment volumes.

Meanwhile, BoC’s Poloz sees the economy in “good shape” even though the bank is dealing with low oil prices and risks to the global trading system, according to a Bloomberg TV interview. He acknowledged that oil prices were very weak in Q4 and this has provided a “material shock” to the outlook for the Canadian economy, though if trade tensions were resolved that could boost the economy. He reiterated that the pace of future interest rate hikes in Canada will be data dependent, though as to the data – the US shutdown hit the Canada trade report, so it can’t fully show the impact of trade tensions on exports.

USDCAD rallied over 1.3340 from 1.3305 following the weaker Canada retail sales outcome. The pairing had slipped from overnight highs over 1.3360. A sharp reversal indeed. The H1 EMA Strategy would have triggered overnight and reached T1 earlier today and T2 would not have been reached before the reversal triggered at 16:00. The daily pivot and 20-period moving average is now initial Support at 1.3335 with Resistance now at the overnight high around 1.3360.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.