USD drop below the 104 mark (USDIndex 103.70), Stocks led the rise in Asian equity indexes, with news that the PBOC made the largest cash injection in three months. Yields (+3.17%) up as markets continue to weigh recession risks and central bank outlooks. Oil corrected at 107.46, Gold higher and BTC steady. Russia defaulted on its foreign debt for the first time since 1918. The grace period on two eurobond coupons worth around $100 million expired on Sunday, according to Bloomberg, which means the country is officially in default.

- USDIndex down to 103.70 yesterday before slipping back to 104.00 now.

- Equities – Hang Seng rallied 2.5%, the CSI300 is up 1.3%, while JPN225 and ASX closed with gains of 1.5% and 1.9% respectively, the latter boosted also by energy companies. GER30 and UK100 futures are up 0.5% and US futures have pared earlier losses and are posting fractional gains.

- Yields 10-year is up 3.8 bp at 3.17%, the 10-year Bund yield has gained 4.1 bp and is at 1.47% as markets continue to weigh recession risks and central bank outlooks.

- Oil & Gold higher to $107.60 and $1,835.16 respectively. – Brent saw levels below USD 112 amid concern of waning demand amid slowing world growth

- Bitcoin flat at $21,227.

- FX Markets – EURUSD is at 1.0556, USDJPY fractionally above 135, Cable trades at 1.2290 now, ranging since Friday.

- Reuters:

- Goldman Sachs forecasts a 30% chance of the US economy tipping into recession over the next year – versus 15% earlier – while Morgan Stanley places US recession odds for the next 12 months at around 35%.

- Citi forecasts a near-50% probability of global recession.

Today – Focus is on US Durable goods but also on the Personal Consumption Expenditures (PCE) price index data on Thursday for further confirmation that price pressures remain heated. Chinese factory activity data due to be released later this week could provide a guide as to whether the world’s second-largest economy is finding momentum again after the disruption caused by strict COVID-19 lockdown measures.

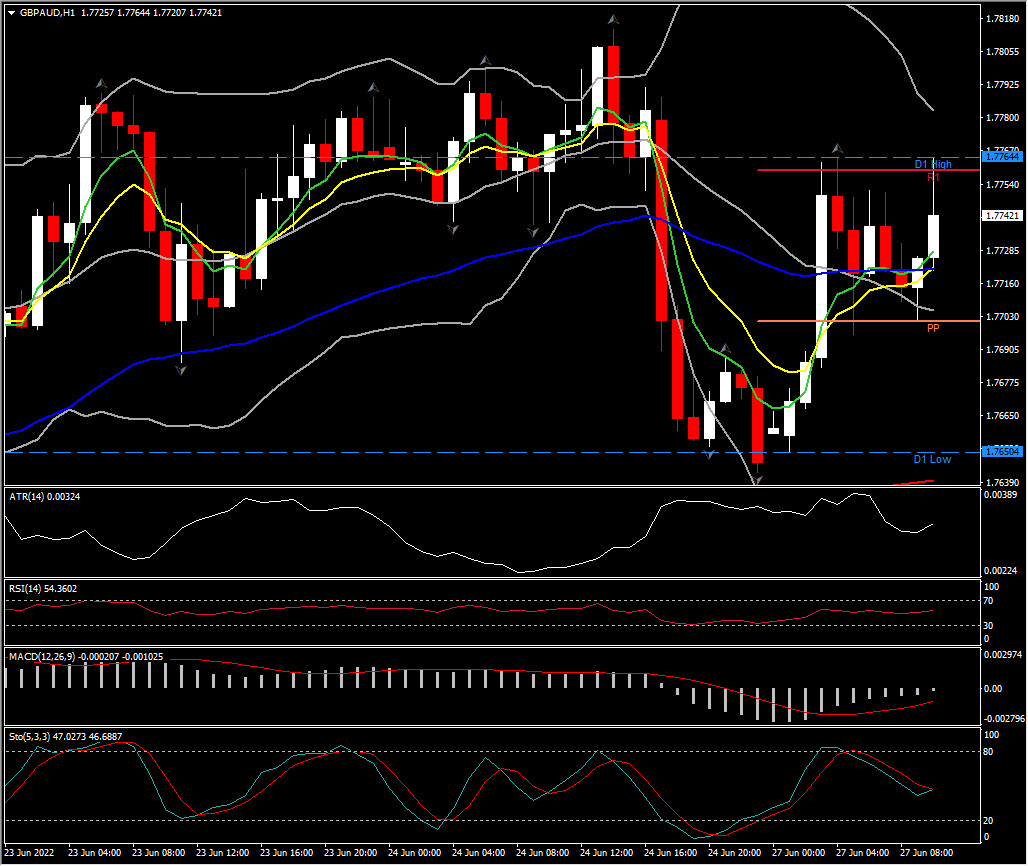

Biggest FX Mover @ (06:30 GMT) GBPAUD (+0.83%). Rallied from 1.7650 to 1.7765. MAs aligning higher, MACD histogram at neutral, RSI 54.63 & rising, H1 ATR 0.00324, Daily ATR 0.01633.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.