FX News Today

- 10-year Treasury yields are up 1.6 bp at 2.732% while JGB yields fell back -0.4 bp to -0.008%, despite broad gains on Asian stock markets overnight.

- Topix and Nikkei managed gains of 0.87% and 0.97% respectively. The Hang Seng is up 1.44% and the CSI 300 1.23%. The ASX climbed 0.8%, lifted by higher commodity prices.

- Earnings reports have helped to prop up market sentiment this week, despite the fact that economists and central banks are now catching up with the gloomy view on the outlook for world growth that already sent markets lower at the end of last year.

- The global cyclical chip sector seems to be recovering, which is underpinning tech stocks.

- US and European stock futures are also posting broad gains, suggesting an overall positive end to the week, with markets now bracing for key events next week including the continuation of US-Sino trade talks as well as the Fed meeting.

- ECB’s Coeure commented that it’s too early to discuss whether ECB will hike rates this year, while adding that the central bank may have to adjust rate guidance at some point. Coeure admitted in a Bloomberg interview that the economic slowdown has surprised the central bank although he also added that the jury is still out on how persistent the slowdown will be.

Charts of the Day

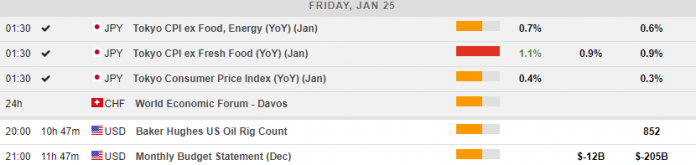

Main Macro Events Today

- Baker Hughes US Oil Rig Count – Oil Rigs stood at 852 last week, with the number of drills highly dependent on the price of Oil.

- US Monthly Budget Statement – In view of the US government shutdown, the Budget Statement in December is expected to be much lower than the previous month, at a deficit of 12 billion, compared to a deficit of 205 billion in November.

- World Economic Forum at Davos – The third day of the WEF annual meetings held in Davos and attended by officials from over 90 countries. Comments from central bankers and other influential officials can create significant market volatility.

- German Ifo Business Climate – Following the slowdown in the German economy, business climate is expected to decline to 100.7 compared to 101.0 in the previous month.

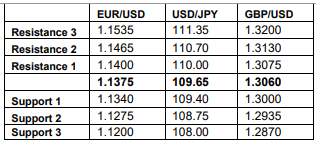

Support and Resistance Levels

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.