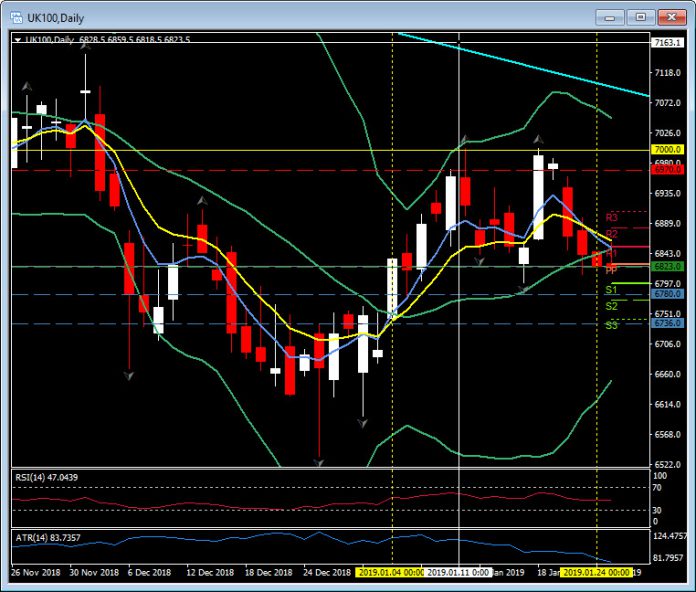

UK100, Daily

The UK100 closed last night (January 24) under the 20-day Moving Average for the first time in 15 trading days. This was a return to the higher time frame trend for the daily chart. The UK100 has lost some 175 points this week and is closing its first losing week in five.

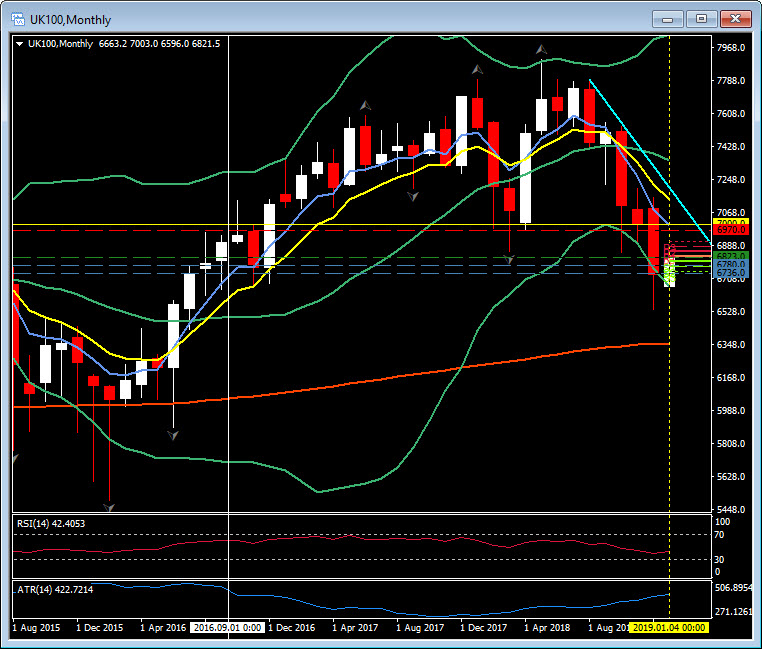

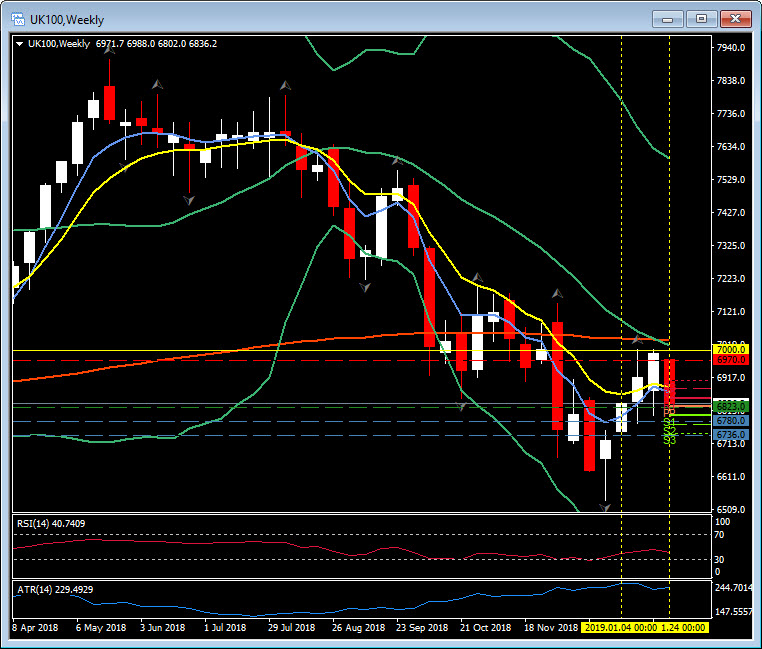

The four-week rally stalled at the psychological 7,000 zone and the key 20-period Moving Average. The last time the weekly chart was north of the 20-period MA was during August 2018, and the Monthly chart also turned south at the same time. The January 2019 rally has recovered less than 30% of the 350+ points it lost during the aggressive December 2018 sell-off and less than 8% of the Q4 sell-off.

The Return to Trend Strategy on the Daily time frame would have triggered last night at 6823 and the break of the 20-day Moving Average.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.