Cintas Corporation, an American corporation which offers businesses in a range of products and services including uniforms, restroom supplies, mats, mops, fire extinguishers and testing, as well as first aid and safety products, is scheduled to report its earnings results for the quarter ended May 2022 on 14th July (Thursday) before market open.

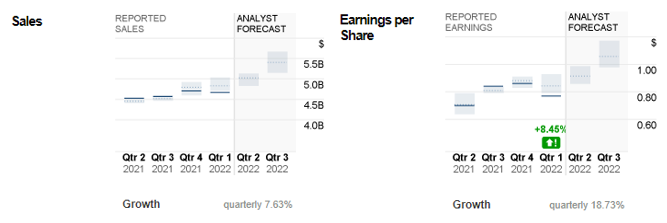

Fig 1:Reported Sales and EPS versus Analyst Forecast for Cintas

Source:money.cnn

In general, Cintas Corporation performed on par with market expectation for the past few years. In the previous quarter, the company reported $2 billion sales while adjusted earnings per share (EPS) stood at $2.69. Most of the company’s revenues for the quarter derived from the Uniform Rental and Facility Services segment, which was up 9.6% y/y to $1.55 billion, followed by First Aid and Safety Services segment (up 7.3% y/y to $213 million) and All Other segment (up 20.9% y/y to $194.3 million). Source TipRanks)

For the upcoming earnings announcement, sales are expected to remain at $2 billion, slightly up 11.11% from the same period last year. On the other hand, EPS is expected to achieve $2.68, up 8.5% compared to Q4 2020. Overall, for full year 2021, sales and EPS are expected to hit $7.8B and $11.36, respectively, up 9.86% and 10.94% from the previous year.

Technical Overview:

The Daily chart shows #Cintas traded within a descending channel, a technical correction from bullish phase since Feb 2020 (low: $153.24) to Dec 2021 (high: $461.14). In general, the company’s share price remains 22.66% below the median estimate of analysts. $384.20 and the 100-day SMA serve as the nearest resistance. Breaking above these levels may indicate the bulls to extend its gains towards the next resistance at $398.90, the upper line of descending channel and $413.60. Otherwise, if share price retraces, the nearest support to watch is $366, followed by $350 and $336.60.

Charles Schwab Corporation, an American multinational financial services company that offers brokerage, banking and financial advisory services through its operating subsidiaries, is also expected to release its Q2 2022 earnings result also 14th July (Thursday), before market open.

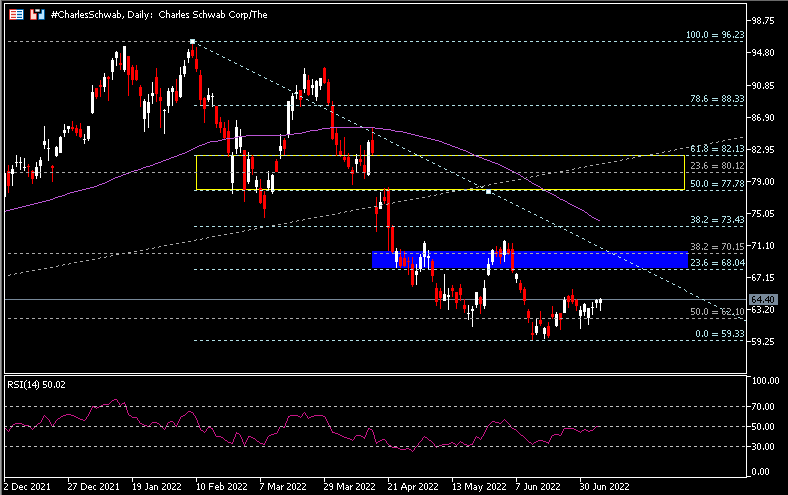

Fig 2:Reported Sales and EPS versus Analyst Forecast for Charles Schwab.

Source money.cnn

In the previous quarter, Charles Schwab reported $4.7B sales and adjusted EPS at $0.77. Both figures missed consensus estimates. Net income was $1.4B, down -12.5% (q/q) and -6.67% (y/y). Despite encountering a complex set of crosscurrents, CEO Walt Bettinger remains optimistic on Charles Schwab’s prospects following its “contemporary full-service model and no “trade-offs” approach to value, service, transparency and trust”, which in turn is boosting client engagement and account openings. It is known as one of the “big four brokerages”, with over $4 trillion in client assets and over 12 million active brokerage accounts. Consensus estimates for sales in the coming announcement remains unchanged at $2.0B, whereas EPS is expected to hit $2.68.

Technical Overview:

Technically, #CharlesSchwab shares price remains supported above the highs seen in January last year, $62.03 and $62.10 (FR 50.0% extended from the lows in March 2020 to the highs in February 2022). $68.05 – $70.15 serves as minor resistance zone. If the bulls successfully break above the zone, #CharlesSchwab shares price may see more upward potential towards the next resistance at $73.45 (near to 100-day SMA), and the range between $77.80 to $82.15. On the contrary, if price breaks below the said support, the next level to watch will be $59.30 and $54.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.