The new month kicks off with the Dollar on the defence, as investors digest the weak Q2 GDP data (-0.9%) which has put the US in a technical recession.

Dollar

The Greenback begins the week under significant pressure largely driven by the GDP data that came out last week, confirming two consecutive quarters of negative growth. This key development, along with the likelihood of the FED responding with further tightening in the coming months, has weakened the outlook for the Dollar in the short-term and as a result we saw the index hit a three-week low in the morning session. Going into the week, investors will be looking at key economic data such as final manufacturing PMI and initial jobless claims as well as the Non-Farm Payroll.

Technical Analysis (H4)

Technical Analysis (H4)

In terms of market structure, price has confirmed the formation of the bearish continuation pattern (Bear Flag) that we discussed last week and has gone on to break the major trendline that has been holding the uptrend since 29 May 2022. The impulsive nature of the break puts sellers in control to potentially hit the first technical level around the 104.55 area.

Euro

The Euro began this week trading at three-week highs at the 1.02678 area, on the back of weaker dollar demand and improved risk-sentiment in the market. Since bottoming out at parity, the Euro has been buoyed somewhat and some commentators are linking this to the ongoing US recession fears that have been on the horizon for a while now. However, this lift could be short-lived as investors will be monitoring the supply of Russian gas flows because of the larger economic effect it will have on the European Union as a whole, with potential shortages which are leading to sky-high prices that could last until 2024.

Technical Analysis (H4)

In terms of market structure, price is still locked in the potential bullish continuation pattern (Bull Flag) that we identified last week. An impulsive break above the structure at the 1.02786 area will be the catalyst for the confirmation of this pattern and will put buyers in the driving seat to challenge the 1.04518 area. On the flipside, if the above-mentioned scenario fails, price could potentially revisit last week’s lows around the 1.01320 area.

Pound

Sterling kicked off the week continuing its three-week bullish momentum hitting a three-week high on Monday in the London session. A key factor driving this exuberance is the sentiment that monetary policies between the BoE and the US FED are narrowing as the BoE positions itself for a 50bps rate hike on Thursday in contrast to the cautious stance that the FED is beginning to take going into the latter half of the year.

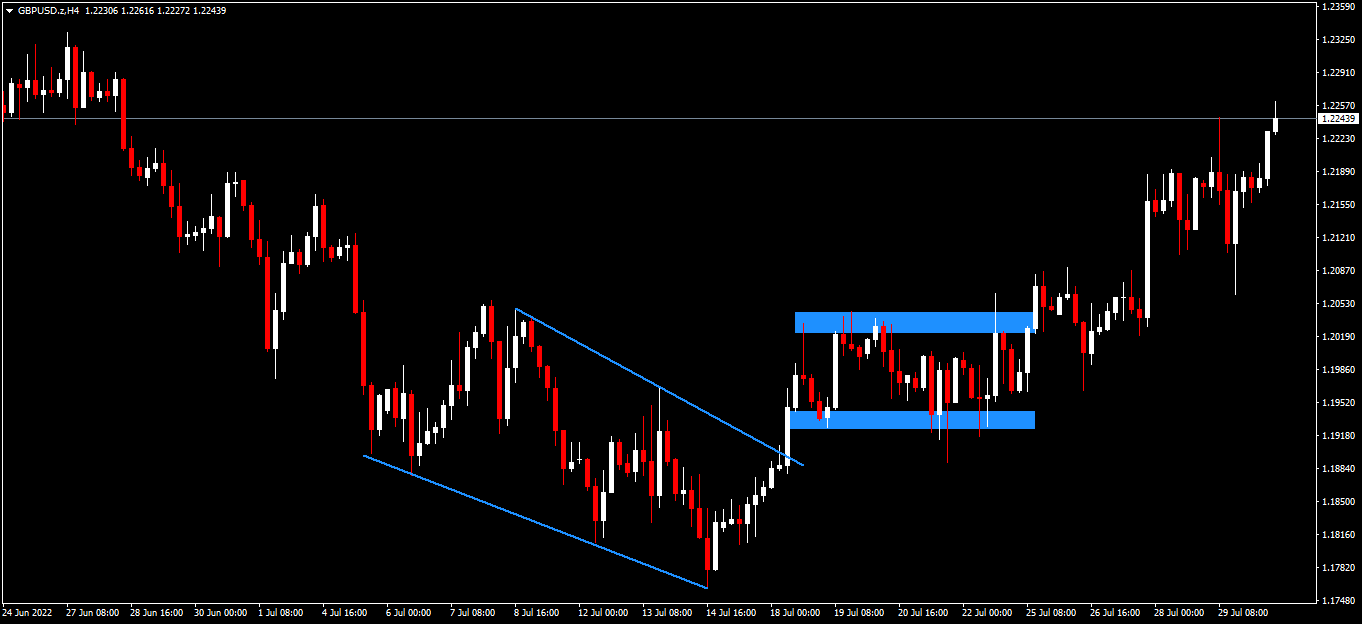

Technical Analysis (H4)

In terms of market structure, price confirmed the bullish continuation pattern (Bull Flag) that we identified last week, by printing out an impulsive break to the upside. As it stands, buyers are in firm control of price and will likely challenge the 1.23332 area henceforth.

Gold

The yellow metal came out the gate holding onto gains from last week, hitting a three-week high on Monday morning during the London session. These gains are heavily linked to Dollar weakness, as a cheaper dollar makes Gold more accessible to buyers, as well as the growing recession fears which have driven some of the exuberance we are seeing from investors in the safe-haven asset.

Technical Analysis (H4)

In terms of market structure, price has confirmed the bullish continuation pattern (Falling Wedge) by subsequently printing out an impulsive wave above the structure. Going forward, price could potentially stall around current areas at the $1,777 level as it could be a point of interest for sellers. Nevertheless, if bulls continue to drive price up and break above this level impulsively, we could see buyers go on to challenge the $1,812 area.

Click here to access our Economic Calendar

Ofentse Waisi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.