EURUSD fell -0.35% in the first week of August. A rise in T-bill yields over the week and a stronger-than-expected US payrolls report in July pushed the dollar higher and weighed on the Euro. EURUSD moved lower over the week despite better-than-expected Eurozone economic data. German industrial production in June unexpectedly rose +0.4% m/m, higher than expectations for -0.3% m/m. June French industrial production also unexpectedly rose +1.4% m/m, stronger than the expected -0.3% m/m and the biggest rise in 5 months.

This week looks a bit subdued in the Eurozone, with final inflation data the only major release to watch given the current level of central bank activity, but revisions are likely to have less of an impact. Looking ahead to winter, the focus will remain on Russian gas flows as Nord Stream 1 continues to operate at just 20%.

In Germany, water levels in the Rhine River were reported to have fallen to their lowest level since 2018 and are almost impassable for shipments of coal, sand, chemicals and other goods, which could affect trade routes, development and add to energy woes. The water level in the Rhine is likely to drop close to the point where it will effectively stop traffic. The main point for freight shipments in Kaub, Germany will drop to 47cm by the weekend.

Eurozone growth concerns, energy woes and an aggressive Fed are holding back the euro’s gains. The US Dollar however has retreated from its July peak amid improving global market sentiment, as the market is likely to see Fed gains begin to taper as commodity prices have tumbled for several weeks. Meanwhile, the Euro faces many challenges and the EURUSD may remain range bound as the dollar’s rollback continues. However, it may be too early to conclude that the US Dollar has ended its long-term trend amid the positive data reported last week.

Technical Overview

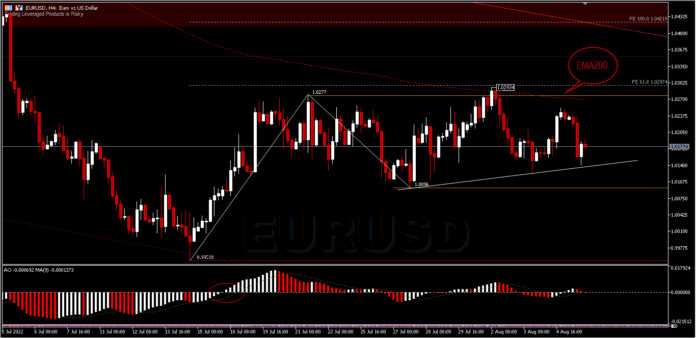

EURUSD had an uncertain week and returned to a trading range bound between 1.0096 – 1.0277. Initial bias remains neutral this week first. On the downside, a break of the minor support at 1.0096 would indicate that the downtrend is not over yet and is ready to resume. The intraday bias will return to the downside to first test the psychological level of 1.0000 and the low of 0.9951. For now, the outlook will remain bearish resistance at 1.0350. On the upside, a move above 1.0293 would bring an intraday bias at 1.0350 or the FE100% projection at 1.0421 (from a temporary pullback at 0.9951 – 1.0277 and 1.0096 lows).

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.